Modi Government misses April 1, 2017 target for GST roll-out

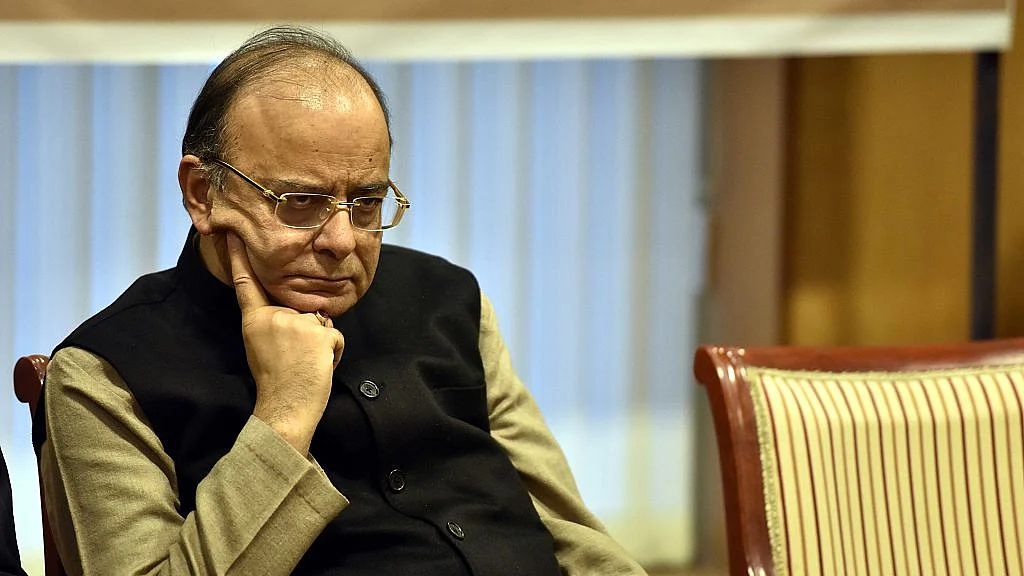

The rollout of the crucial GST Bill, which enjoyed near all-party support, will now miss the original target of April 1 and is likely to roll out only on July 1, said Finance Minister Arun Jaitley

Missing the original target of April 1, the important tax reform Goods and Services Tax (GST) is now likely to roll out only on July 1. Finance Minister Arun Jaitley announced this on Monday after the 9th meeting of the all-powerful GST Council with the Centre and states reaching a consensus on sharing powers for control over tax payers under GST.

“There was a broad view that July 1 appears to be a more realistic date to roll out GST,” said Jaitley.

With Parliament’s Winter Session mostly washed out by a logjam between the NDA government and the Opposition parties mainly over the demonetisation issue, the Centre didn’t seem to be in any hurry to introduce the three Bills—Central GST (CGST), Integrated GST (IGST) and compensation bills—necessary to implement GST. Incidentally, the differences in Parliament did pour into the GST Council meetings as well, and discussions were hitting a wall. The states also wanted more compensation to tide over the losses due to demonetisation.

The Bills, of course, couldn’t have been introduced in Parliament without the Centre and the states reaching a consensus on the different aspects such as tax-sharing formulae. There is a Constitutional compulsion to have a GST in place before September 16. Perhaps the NDA government could have succeeded in meeting the April 1 target if it could have handled better its relations with the Opposition, both in Parliament and in general.

“The GST, in principle, is a good system. It is the failure of Finance Minister Arun Jaitley who could not get the same unanimous decision in the GST Council earlier,” says Prof Saugata Roy, senior Trinamool Congress leader and former Union Minister of State for Urban Development.

It may be noted that Tamil Nadu, West Bengal and Kerala were seeking 100% administrative control over all taxpayers who have an annual turnover of less than ₹1.5 crore, while the Centre did not yield as that would leave it with a very small tax base. Jaitley said that on Monday, the Tamil Nadu Finance Minister made an alternative proposal, which was debated and finally improved upon. Only West Bengal Finance Minister Amit Mitra had stuck to the demand that the states should have full administrative control of all taxpayers below ₹1.5 crore.

The Centre agreed to the demand of states to go in for horizontal split with regard to tax payers based on annual turnover. As per the consensus, for all assessees with a turnover of ₹1.5 crore or less, 90% of them will be assessed for the purposes of scrutiny and audit by states and 10% by the administrative machinery of the Centre. Those above a turnover of above ₹1.5 crore will be assessed in the ratio of 50:50 by states and the Centre.

Jaitley said that the power to levy and collect IGST—an inter-state tax on the movement of goods and services—is with the Centre, but by a special provision in law, the states will also be cross-empowered in the same manner as the above mentioned ratio. In IGST, where there are contentious issues between conflicting states with regarding to place of supply, etc and where one the states can’t obviously assess, there the Centre would take over the assessment.

Not just that, states could also tax any economic activity within 12 nautical miles of its territorial waters, even though it was the Centre which was vested by the Constitution to levy tax in these areas. This had been earlier referred to the Law Ministry for legal opinion.

“Each assessee will be assessed by only one authority,” the Finance Minister reiterated.

Jaitley said that the ministers then worked out the time schedule which has been realistically put at July 1. The Finance Minister said that the Council will meet next on February 18 to approve draft laws for the introduction of GST such as for IGST, CGST and SGST.

It is a known fact that the BJP had opposed GST introduction during the tenure of the Manmohan Singh government, but changed its stance after coming to power. Now, after the delay in introducing the tax reform, it has to be seen how well it will be implemented, especially with the woes of demonetisation still hurting the industry, especially the small players.

All India Manufacturers’ Organisation (AIMO) President KE Raghunathan points out that only the broad parameters of the GST have been announced such as the ratio of tax-sharing between the states and the Centre. The detailed rules and like needs to be filled in. “The manufacturers, especially the small players, have been hit hard by demonetisation. If GST will be implemented from July 1, all announcements of statutory levies or regulations must be made at least by March 31. We need at least three months to prepare for the change,” he said.

What was left unsaid after the FM’s comments was that the timeline for rolling out GST, itself a powerful tool to increase the tax net and combat black money, has been partly upended by the Government’s demonetisation decision on November 8, 2016, which has yet to prove its effectiveness in tackling black money. But the irony was lost on no one.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

- demonetisation

- Arun Jaitley

- black money

- Winter Session

- West Bengal

- Kerala

- Parliament

- Finance Minister

- Opposition

- Tamil Nadu

- Trinamool Congress

- NDA Government

- GST

- West Bengal Finance Minister

- Amit Mitra

- Goods and Services Tax

- UPA Government

- Modi government

- GST Council

- tax reform

- Central GST

- CGST

- Integrated GST

- IGST

- Saugata Roy