CEA opposes Jaitley, Panagariya on Agriculture Income Tax

As controversy rages on Agriculture Income Tax and the Centre passes the buck to the states, the question nobody is asking is, who are the people the Centre is trying to protect ?

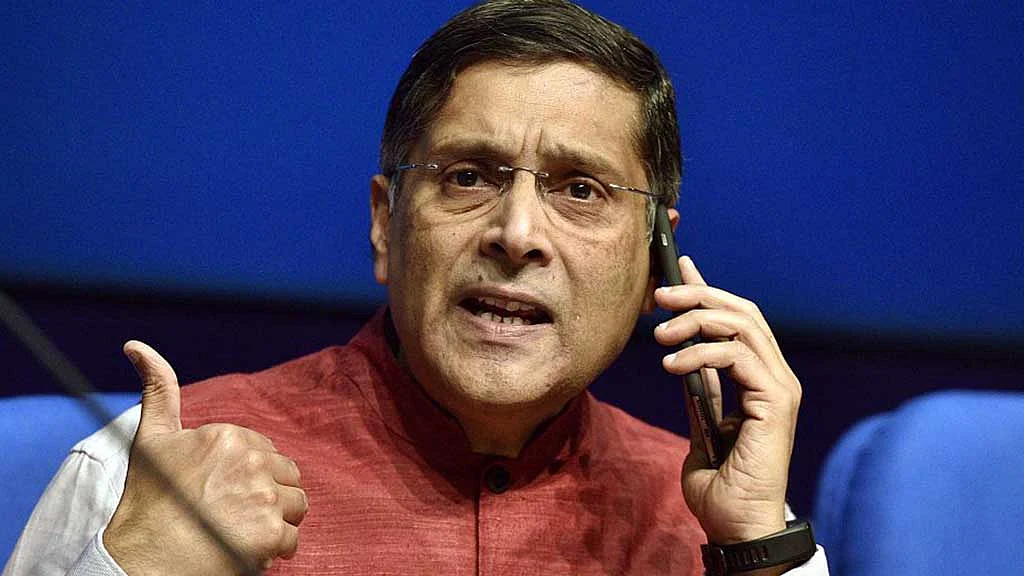

A day after Finance Minister Arun Jaitley and Niti Aayog Vice Chairman Arvind Panagariya ruled out that the Government was planning to introduce Agriculture Income Tax, the Chief Economic Advisor to the Government, Arvind Subramaniam spoke out strongly in favour of the move, explaining that the tax needed to be levied on rich farmers and not the poor.

While Subramaniam went against Jaitley and Panagariya and asked rhetorically, “ How difficult is it to distinguish between rich and poor farmers”, Niti Aayog member Bibek Debroy had initially made the same point while speaking in favour of bringing agriculture income into the tax net. The personal income tax , he said, should be levied on income above a ceiling and that he did not favour the artificial divide between urban and rural income.

Panagariya, however, was quoted by PTI as saying, “ "80% of rural areas are connected to agriculture and we are talking about doubling farmers' income. How can we talk about taxing farmers income?"

"There is nothing of taxing agriculture income... in the document," Panagariya said, adding that the nearest thing that was mentioned in the 3-year action agenda was, loopholes should be plugged to prevent non-agriculturists from converting their black money into white by showing it as agriculture income.

But then how many people actually show agriculture income in their Income Tax(IT) returns?

In a written reply to the Rajya Sabha member of JD(U) Ali Anwar in 2015, finance ministry had disclosed the number of IT returnees claiming tax exemption on their agriculture-income to be just 18 thousand. If 3 lakh people filed IT returns in 2014-15, 18 thousand would be merely 6% of them.

But while the fin-min’s reply did not furnish more details, it has been suspected for long that a majority of these 18 thousand people happen to be politicians, industrialists, businessmen and bureaucrats whose agriculture income would possibly run into several crores of rupees per annum.

Not only do they claim and receive exemption but there is also the possibility that because of lack of scrutiny, agriculture income is used by many for window-dressing their black money earned from other sources.

Both Panagariya and Subramaniam, however, have pointed out that states can target rich farmers and tax them.

On farm loan waiver, the NITI Aayog Vice-Chairman said, "States are empowered to waive farm loan... Besides their priorities, states are bound by the FRBM Act."

But while the Centre has neatly passed the buck to the states, the latter can do little to tax income, which is the preserve of the central government. But the Centre is clearly not enthusiastic about taxing the rich farmers, not even the 18 thousand who have been claiming exemption from paying income tax on their agriculture income.

It is, however, not understood why the Government cannot fix a higher ceiling for agriculture income, say ₹10 lakh, and tax income over and above this amount ?

Who are the people the Central Government is trying to protect ?

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines