Bike Loan Interest Rate vs Processing Fee: What’s Costing You More?

Learn how to calculate the costs so you choose the best two-wheeler loan for your needs

Owning a bike can be a dream for many, and a Bike Loan can make it possible without putting pressure on your savings. However, when applying for finance, it is important to look beyond just the Bike Loan interest rate. The processing fee is another cost that affects the total amount you pay. Understanding the difference between the two and how they impact your loan will help you make the right borrowing decision.

Understanding Bike Loan Interest Rate

A Bike Loan interest rate is the cost charged by the lender for lending you money to purchase your bike. It is usually expressed as a percentage and is applied to the outstanding principal amount.

There are two main types of interest rates:

● Fixed Interest Rate – The rate stays the same throughout the loan tenure, ensuring predictable EMIs.

● Floating Interest Rate – The rate changes as per market conditions, which may result in lower or higher EMIs over time.

The interest rate you get depends on factors such as your credit score, income, loan tenure, vehicle model, and relationship with the lender. Even a small difference in interest rate can significantly affect your monthly instalments and the total interest paid.

Example:

If you take a loan of ₹ 1.5 Lakh for 3 Years at 8%, your monthly EMI will be around ₹ 4,700. If the interest rate is reduced to 7%, the EMI becomes about ₹ 4,630, saving you money every month and reducing the overall cost.

Understanding Processing Fee

The processing fee is a one-time charge collected by the lender to process your loan application. It covers administrative costs like document verification, credit checks, and loan setup.

This fee is usually a fixed percentage of the loan amount, often between 0.5% and 2%. Some lenders set a minimum and maximum cap for this charge.

Example:

If your loan amount is ₹ 1.5 Lakh and the processing fee is 1%, you will have to pay ₹ 1,500 upfront (plus applicable taxes). While this may seem like a small amount compared to the total loan, it adds to your initial cost of borrowing.

Which Costs You More?

Whether the Bike Loan interest rate or the processing fee costs more depends on the loan amount and tenure.

● Over longer tenures, even a small change in interest rate can have a larger impact on the total cost than the processing fee.

● For shorter tenures, the difference in total interest paid may be smaller, and the processing fee could represent a more significant share of your borrowing cost.

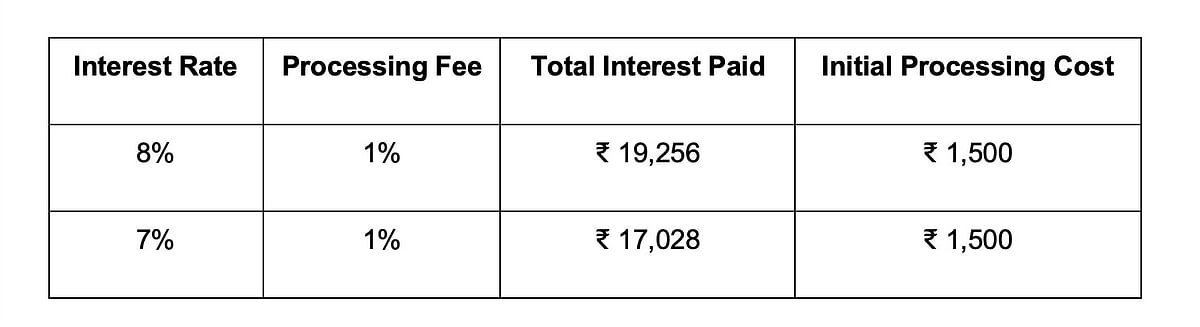

Illustration:

Loan Amount: ₹ 1.5 Lakh

Tenure: 3 Years

Here, a 1% lower interest rate saves about ₹ 2,228 in total interest, which is more than the processing fee amount.

Tips to Reduce Overall Loan Cost

1. Compare Multiple Lenders

Do not just focus on the lowest Bike Loan interest rate. Compare processing fees and other charges to find the best overall deal.

2. Negotiate the Processing Fee

Some lenders may be willing to reduce or waive the processing fee, especially if you have a good credit history or are an existing customer.

3. Improve Your Credit Score

A higher score can help you secure a lower interest rate, reducing the total cost over time.

4. Choose the Right Tenure

A shorter tenure will reduce interest payments, but make sure the EMI is affordable.

5. Make a Larger Down Payment

This reduces the loan amount, which can lead to both lower interest costs and reduced processing fees.

Documents Required for a Bike Loan

To apply for a Bike Loan, you will generally need the following:

● Identity Proof – PAN Card, Aadhar Card, Passport, Voter ID, or Driving Licence

● Address Proof – Ration Card, Utility Bill, Passport, or Driving Licence

● Income Proof – Salary slips, bank statements, Form 16, or income tax returns

● Age Proof – Birth Certificate, Passport, or Class 10 Marksheet

● Photographs – Passport-size photographs as required by the lender

Final Thoughts

When choosing a Bike Loan, it is important to evaluate both the interest rate and the processing fee together. While the interest rate usually has a larger impact over the life of the loan, the processing fee is an immediate cost that affects your upfront expenses. A careful balance between the two, along with other charges and loan features, will ensure you get the best deal for your dream bike without overpaying.

This is an advertorial. The article is being published as received.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines