Difference Between Comprehensive and Third-Party Bike Insurance

A comprehensive bike insurance policy offers broader protection by combining third-party liability coverage with own-damage cover

Choosing the right insurance policy for your two-wheeler depends on how much protection you want and how much risk you are willing to take. In India, third-party bike insurance is mandatory under the Motor Vehicles Act, which is why many riders start with it by default. However, it offers limited coverage when compared to a comprehensive policy.

Understanding how these two types of insurance differ can help you make a more informed decision and avoid unexpected expenses later.

What is Third-Party Bike Insurance?

Under bike insurance, a third-party policy is designed to cover legal liabilities arising from injury, death or property damage caused to someone else due to your bike. It does not cover any damage to your own vehicle, whether due to accident, theft, fire or natural calamities.

This type of policy is legally required and generally comes at a lower premium, making it attractive for riders looking to meet compliance requirements at minimal cost. However, the limited scope of coverage means the rider must bear all own-damage repair expenses.

What is Comprehensive Bike Insurance?

A comprehensive bike insurance policy offers broader protection by combining third-party liability coverage with own-damage cover. This means it not only fulfills legal obligations but also protects your bike against accidents, theft, fire, natural disasters and man-made events.

In addition, comprehensive insurance allows riders to enhance coverage with optional add-ons such as zero depreciation, roadside assistance and engine protection. While the premium is higher than a third-party policy, the financial protection offered is significantly wider.

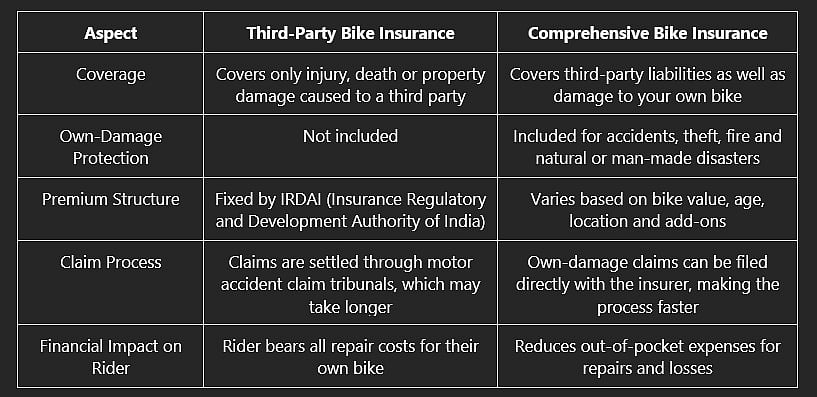

Comprehensive vs Third-Party Bike Insurance: Key Differences

Which Bike Insurance Policy is Right for You?

If you own an older bike, use it occasionally or are primarily focused on legal compliance, third-party insurance may be sufficient. However, if your bike is new, frequently used or expensive to repair, a comprehensive policy offers better financial protection.

Riders in high-traffic cities or those who rely on their bikes daily may find comprehensive insurance more suitable, given their increased exposure to accidents and damage.

Risks of Choosing Only Third-Party Bike Insurance

Relying solely on third-party insurance means any damage to your own bike must be paid for out of pocket. Even minor accidents can result in significant repair bills, especially with modern two-wheelers. There is also no protection against theft or natural disasters, which can lead to complete financial loss.

Why Bike Insurance from TATA AIG Makes a Difference

TATA AIG provides insurance options that suit different types of riders, whether someone is looking for a simple third-party cover or broader protection through a comprehensive policy. Its cashless garage network makes repairs easier to manage and the policy terms are laid out clearly, without unnecessary complexity. Combined with a structured claims process, TATA AIG offers coverage that riders can rely on, supported by a long-standing and recognised insurance brand.

This is an advertorial. The article is published as received.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines