Why Gold Loans Are Safer Than Unsecured Borrowings

Understanding the difference with personal loans shows why gold loans are often the safer and more practical choice

When you need quick funds, you usually have two broad options: a loan that is secured by an asset, or one that is not. A gold loan falls into the first category, where your jewellery or coins act as security. An unsecured loan, like a personal loan, depends entirely on your income and credit profile. Understanding the difference shows why gold loans are often the safer and more practical choice.

What Is a Loan Against Gold?

A loan against gold is a secured loan. You pledge your gold jewellery or coins with a bank or NBFC, and the lender evaluates its weight, purity, and market value. Based on this, you receive a loan amount, usually up to a percentage of the gold’s value. Your gold is stored securely for the entire loan period and returned once you repay the loan and interest.

How Do Gold Loans Work?

The process is simple and designed for speed. You bring your gold for valuation, where the lender checks its purity and weight before deciding the loan amount. The gold loan rate of interest is then determined based on the lender’s policy and your loan amount. Once agreed, the loan is disbursed quickly, often on the same day. Minimal documentation is required, usually just basic KYC proofs, making the process far easier than many other forms of borrowing. While you use the funds, your gold remains safe in the lender’s custody, stored in secure and often insured vaults. After the full repayment of principal and interest, your gold is promptly returned to you in the same condition.

Benefits of Gold Loans

A gold loan offers several advantages:

● Quick disbursal, often within hours.

● Lower interest rates compared to many unsecured loans.

● Minimal paperwork.

● Flexible repayment through EMIs, interest-first, or bullet payments.

● Security of pledged gold, often with insurance cover.

These features make gold loans a reliable option for both emergencies and planned expenses.

What Is an Unsecured Loan?

An unsecured loan, such as a personal loan or credit card borrowing, does not require any collateral. Approval depends on your credit score, income, and repayment record. Since there is no asset pledged, lenders face higher risk, which is why interest rates are generally higher. The approval process is stricter and may take longer. Borrowers are often asked to provide detailed documentation, including income proof, bank statements, and employment details. Because of this, unsecured loans are less accessible to those without a strong financial profile, making them a costlier and more selective form of borrowing compared to secured options.

How Do Unsecured Loans Work?

Lenders consider your ability to repay when you apply for an unsecured loan. They thoroughly examine your credit history to determine how you have previously handled debt. Income proof, salary slips, or business records are reviewed to evaluate your financial stability. These checks play a major role in disbursal, and applicants with poor credit or inconsistent income frequently have a harder time qualifying. Because the lender’s decision relies entirely on your financial profile, the approval process may take longer and feel more demanding compared to a secured loan like a gold loan.

If you default on an unsecured loan, the consequences can be serious. The lender cannot directly reclaim any pledged asset because there is no collateral to recover funds. Rather, your credit score suffers greatly, which restricts your ability to borrow money in the future. Legal recovery actions, such as collection calls or, in extreme circumstances, court action, may also be started. The lack of security means that the borrower faces reputational damage and long-term financial stress, while the lender carries higher risk, which is reflected in the higher interest rates charged for these loans.

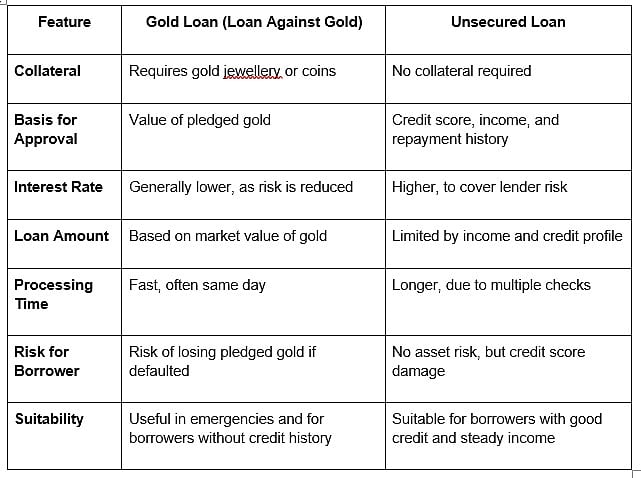

Gold Loan vs Unsecured Loan

Here is a clear comparison to understand the differences:

Why Are Gold Loans Considered Safer?

A loan against gold is considered safer because it is backed by a tangible asset. For lenders, the collateral reduces risk. For the borrower, it means quicker access to funds, cheaper borrowing costs, and simpler approval. After the loan is paid off, your gold is safely stored and returned. The procedure is easier, faster, and more transparent than with unsecured loans.

Conclusion

The two loan types serve different purposes in personal finance, although they both exist. The gold loan emerges as the best option when you require fast money with low risk exposure. The loan system enables you to access gold value without selling your assets while maintaining complete protection of your assets. The financial world today shows that gold loans remain a trustworthy funding option that people and businesses use frequently.

This is an advertorial. The article is published as received.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines