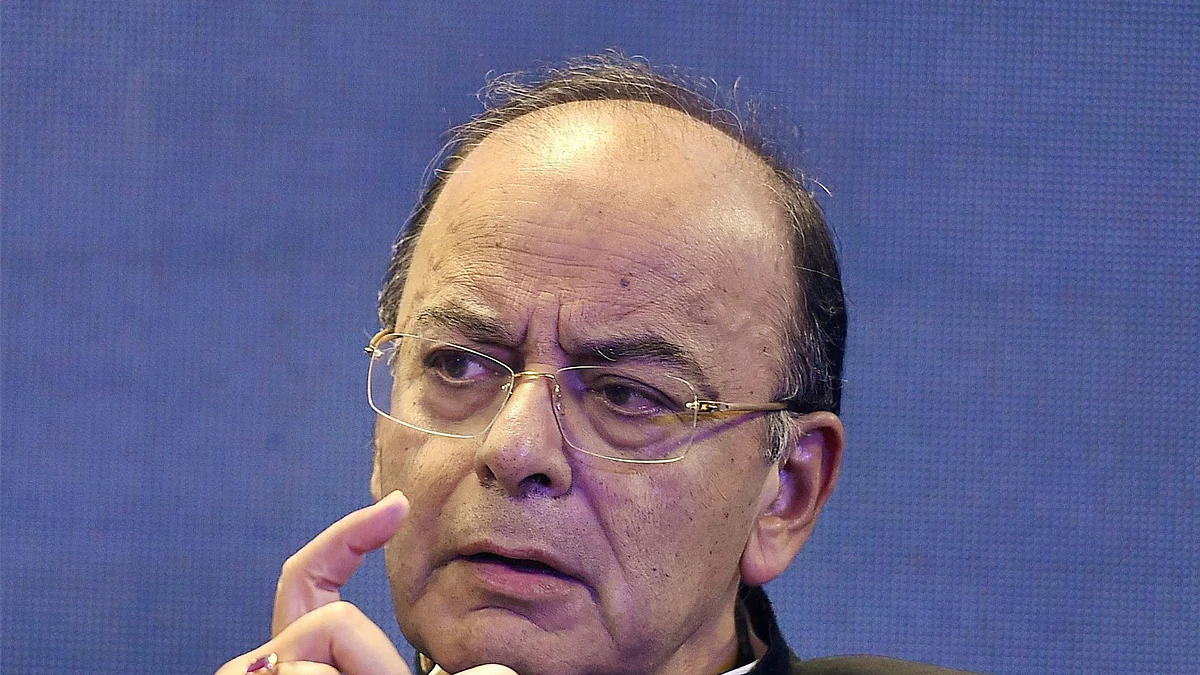

What’s good for the Govt is good for the citizen, says Jaitley

A day after the Annual Report of the Reserve Bank of India conceded that less than one per cent of the demonetised currency have returned to the banking system, the FM stoutly defended the exercise again at a summit organised by The Economist

Union Finance Minister Arun Jaitley on Thursday was spared the blushes at the Economist India Summit, where the audience overwhelmingly voted to suggest that demonetisation had benefitted the country. He was not asked to explain statements made by the Prime Minister on Independence Day and by the former Attorney General before the Supreme Court that Rs 3 and Rs 5 lakh crore of currency had failed to return to the banks. But he stoutly maintained that while the government had not been able to eliminate black money completely, demonetisation had benefitted the government both politically and financially. But has it benefitted the average Indian? Jaitley had no answer to the googly, mumbling that what was good for the government was good for the citizen.

Here are some of the replies Jaitley gave:

Did you expect such high rate of return?

There was uncertainty following demonetisation because there was no model. It had not been tried anywhere on such a scale. There was speculation on how much money would return to the banks and it was of media interest. But it was not of great concern to us in the government. Of course, it is obvious that a large number of people found ways and means to put their unaccounted money in the banks.

But did the exercise serve its purpose?

The fallout has been on predicted lines. The money may have come back to the banks and the anonymity of the holders is no longer there. We have done a lot of data mining, the tax net has increased; digitisation of the economy, which was never at centrestage, progressed and there was 25 per cent increase in Personal Income Tax Returns.

Perhaps demonetisation was good for the ministry of finance. But was it good for the average Indian citizen?

What is good for India and the ministry of finance is good for the Indian citizen. I don’t think Indians want to continue with a system in which in real estate transactions you have to pay in different colours of money and businesses have to keep two sets of account books. Demonetisation and digitisation are steps to reform the system and what is more, politically, this has been accepted by the people and we won an important election after demonetisation.

But millions lost their livelihood and demonetisation was sought to be justified by claiming that Rs three to four lakh crore would be eliminated from the system. Wouldn’t there be some disappointment?

It is nobody’s case that black money has been totally eliminated. But it has gone down significantly. Moreover, the RBI Annual report also mentions that the number of suspicious transactions has gone up sharply after demonetisation. The fact that they are getting identified shows we are moving in the right direction.

But hasn’t demonetisation hit the growth rate? It had a cost and the RBI’s own balance sheet was affected, which is why it paid lower dividend to the govt…in addition there was this cost of printing currency notes…

That is, I would say, a very narrow way of looking at it. If you look at the larger impact, 25 per cent more people filed their Income Tax Returns. GST target has already been exceeded. With revenue of the government going up, the ability to spend goes up. The integration of the non-formal and formal economy is happening and the long-term effect will be beneficial.

But does the government have any estimate of the benefit from demonetisation?

It is too early for me to stick my neck out. But the benefit is significant. While implementing GST, we had assured each state of a 14 per cent annual increase over the next five years. And we have already given them two instalments. The GST roll-out has been very smooth and while only two-third of the returns have come in voluntarily, the target has already been exceeded. So, there is going to be substantial increase in the revenue of both the state and the Union government in the long run.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 31 Aug 2017, 6:55 PM