Banks, LIC and lending institutions ignore RBI circular on moratorium

Both industrial units as well individual borrowers in Jharkhand are being forced to repay loans and EMIs despite the three-month moratorium till the end of May offered by the Reserve Bank of India

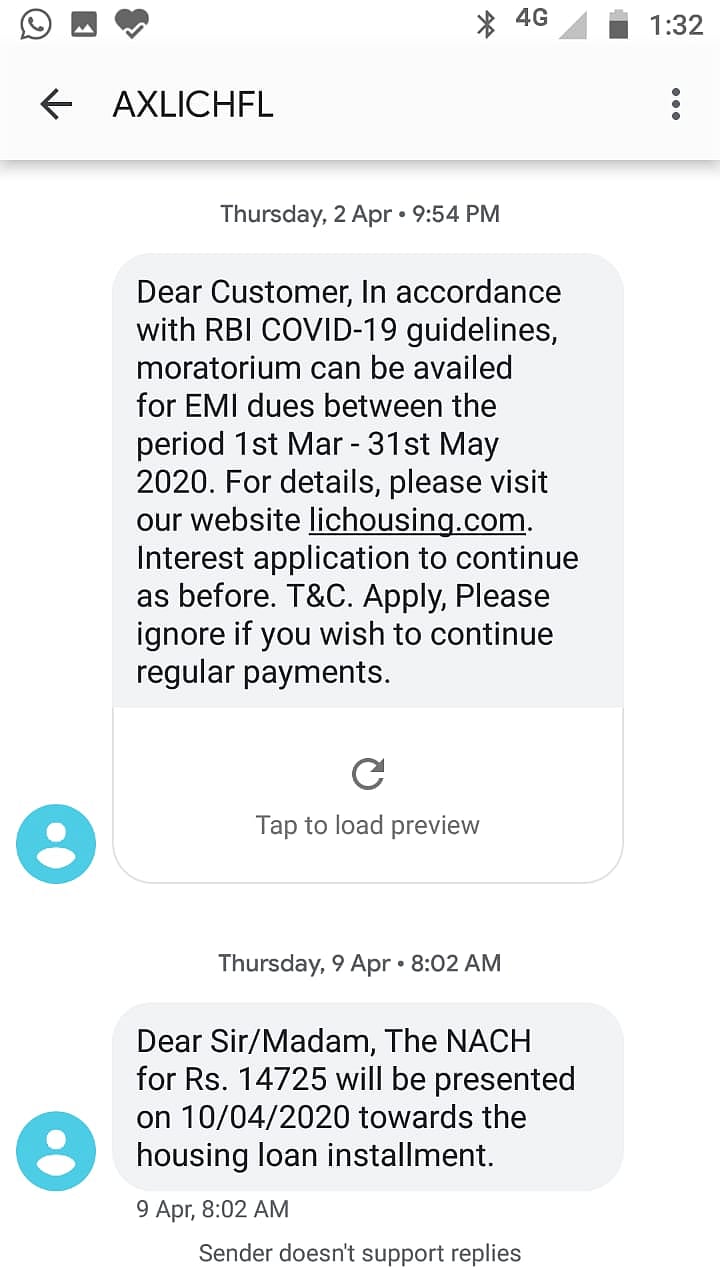

In March the RBI issued a circular allowing banks and financial institutions to provide a three-month moratorium on repayment of loans. This extended to both industrial loan as well as personal loans and was construed to mean that Equated Monthly Instalments (EMIs) could be deferred till May 31. (See RBI circular and messages sent by LIC)

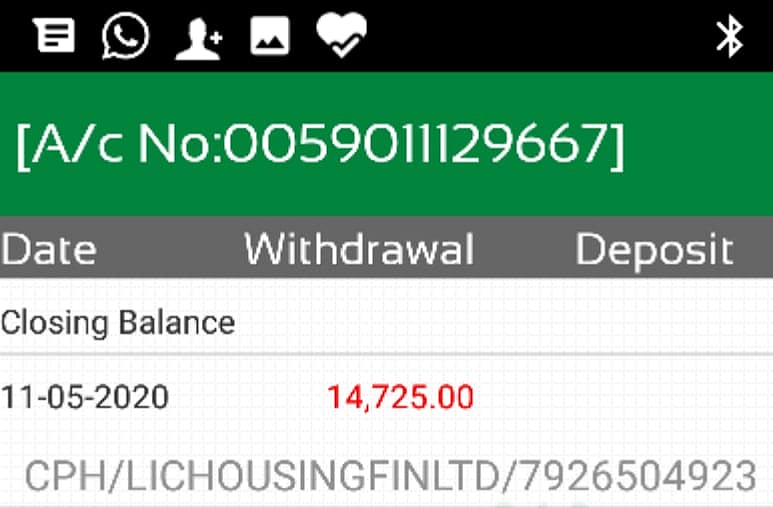

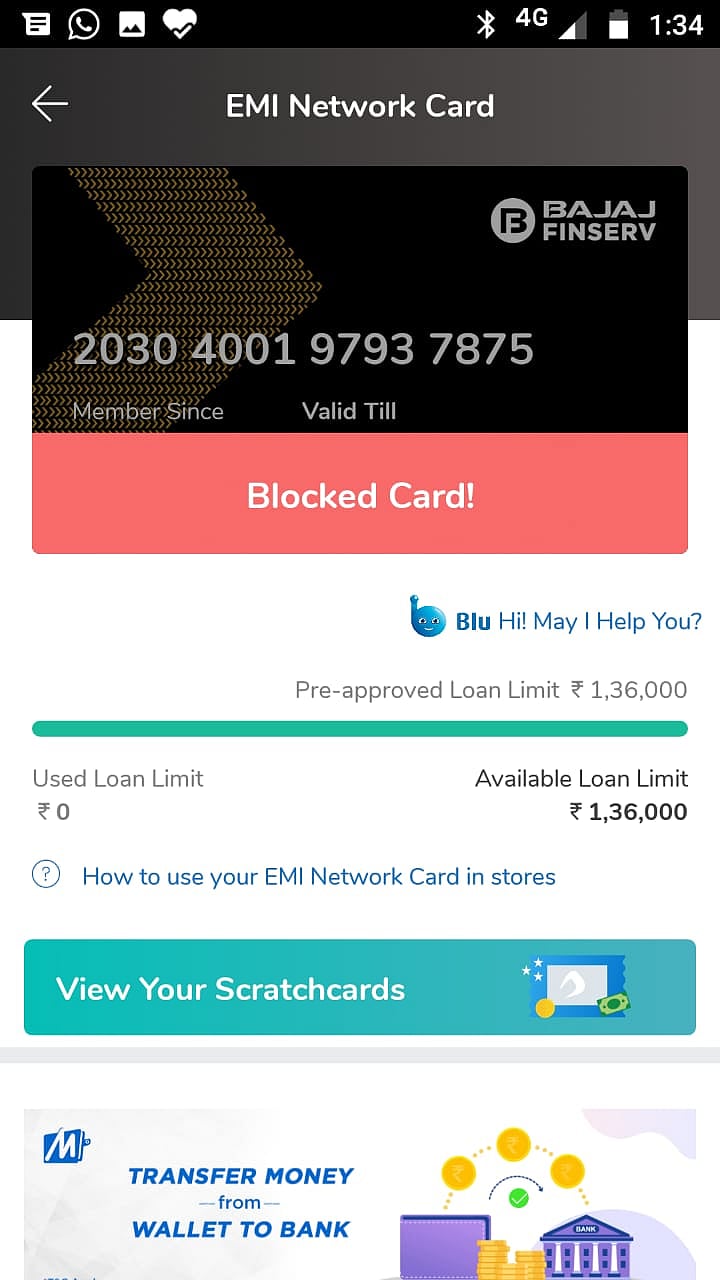

But in gross disregard of RBI circulars, the banks and financial institutions have not only deducted EMIs from senior citizens, school teachers who have not received their salary, pensioners and industrial units—but have also imposed penal interest and also blocked credit cards.

They are now angry and in a fix. Why should they be made to pay for taking the RBI circular and notices from lending institutions seriously? Both State Bank of India and Life Insurance Corporation have pressurized borrowers to pay up or be ready to pay very high penal interest rates, they complain.

A moratorium period was deemed to be the time during which borrowers would enjoy exemption from paying EMIs till conditions improved. As per the RBI circular, banks and other financial institutions were allowed to provide a three month moratorium for all term loan instalments which were due between March 1 and May 31, 2020.

The RBI circular had explained that term loans included all types of loans like vehicle loans, home loans, personal loans as also credit card dues which were eligible for the moratorium. The moratorium was for both interest as well as repayment of the principal amount, which meant the moratorium was on the entire EMI.

President of Jharkhand Chamber of Commerce and Industry, Kunal Ajmani, claims that for the small and medium scale industry in the state, this has come as a double whammy. The units, many of which were already sick following the economic slowdown, shut down completely because of the lockdown. But although industrial and business establishments remained totally in operational, with no cash flow, they are now being pressurized to keep paying their EMIs or face the consequences.

The moratorium alone, says Ajmani, was not enough. The RBI and the Government should have waived the interest on the principal amount. The small and medium scale industrial units need hand-holding because of their capacity to offer employment to migrant workers who have returned to the state in large numbers. It is all the more important, therefore, to ensure they do not flounder now.

If gainful employment is not provided to these impoverished people, he apprehended, it would lead to a spurt in criminal activities.

Threats from banks have affected individual borrowers as well. Pramod Kumar, working in an educational institution, has not been able to pay his EMI despite pressure and threats by SBI and HDFC banks to cancel his credit cards. Alok Ranjan, who is also associated with an academic institution, has had his credit cards suspended and blocked.

His home loan EMIs were being debited by LIC Home Finance even after his request to them not to do so. A retired teacher pleaded that since all his income had dried up, he was unable to pay the EMI and now the SBI has blocked his card.

There is no clarity on the ‘moratorium’ yet. And another humanitarian crisis appears to be unfolding, this time in urban India.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines