Chinese loan apps mushrooming in India, threaten borrowers with social shaming, harassment, FIRs

These illegal fintech app-based loans gained prominence because the money is transferred almost instantly, unlike other registered fintech apps

Ajith KS borrowed Rs 35,000 from a Chinese app-based lender for six days and had to repay Rs 47,000. When he delayed payment by a day, the app representatives accessed his contacts, photo gallery and messages and sent publicly shaming messages to all on his list.

Kerala businessman Ajith needed immediate cash to buy material to ensure work came during the pandemic. “SnapIt, the app through which I had borrowed the money, went berserk when I delayed payment by a day. They shared some of my personal photos outing me as a ‘fraud’. It was quite harrowing. They harassed me with threatening calls throughout the day. They said they would inform the police and send collection agents home,” said Ajith. He repaid the amount within an hour, but he ended up borrowing money from the app itself as he couldn’t borrow from anywhere else.

Over 16 weeks, Ajith borrowed a cumulative amount of Rs 5,60,000 and ended up repaying Rs 7,60,000. To put it in perspective, if he had borrowed Rs 35,000 from a non-banking financial company registered with the Reserve Bank of India even at a high interest rate of 18%, he would have had to pay only Rs 41,300.

He is one of the millions across the country who have taken short-term quick loans from app-based lenders during the Covid-19 pandemic. Most of these apps have not been registered with the RBI and hence they are not authorised to lend money. However, the Google Play Store has more than 500 such illegal Chinese apps which are evidently flourishing. Each of these apps have more than 10 lakh downloads within months of the launch.

There have been multiple instances of the app representatives harassing people to the point of suicide. A representative of the fintech app ‘Udhaar Loan’ asked a girl in Tamil Nadu to video call him naked if she did not pay the loan on time. She attempted suicide in November 2020.

Most of the people had borrowed money from apps such as Bubble Loan, Liquid Cash, Cash Bee, Rupee Factory, Paisa Loan, SnapIt Loan, In Need, Rupee Plus, Pan Loan, Cash Port, Wow Paisa, Gold Bowl, Ok Cash, Udhaar Loan, Go Cash, FlashCash, Cash Pot, One Hope and Bily Cash. Two of these – Udhaar Loan and Go Cash – have been made to resemble popular Indian loan apps such as Udhaar and FlipCash. A cursory investigation on any search engine will reveal that none of these rogue fintech apps have websites or contact details.

“Any lender, whether online or offline, has to be a bank or an NBFC. The rules that apply offline, apply online too. If they are not a registered lender, then they are not legal. What they are doing is not compatible with India’s laws. There are effectively doing it informally. So, they are no better or no worse than the loan sharks that you have in your neighbourhood,” said Vinay Kesari, a fintech lawyer.

According to Section 45-IA of the RBI Act, 1934, a Non-banking Financial Company can function only after due registration, in addition to having a net-owned funds of Rs 25 lakh. Even chit fund companies have to be registered under the Chit Funds Act.

The RBI had on March 27, 2020 issued a moratorium on payment of instalments of term loans falling due between March 1, 2020, and May 31, 2020 due to the pandemic. Later, the moratorium was extended till August 31 this year. However, as these apps are illegal and are not registered with the RBI, they do not follow the law.

Srikanth, who works with Cashless Consumer, a collective working to create awareness in the paytech ecosystem, has been tracking digital lending apps and their data practices. “As I went through the apps, I realised that several of them use the same Chinese white-label app and server with names that are similar to popular Indian apps such as ‘Udhaar’. In fact, many borrowers with the original Indian ‘Udhaar App’ end up at the Chinese ‘Udhaar Loan’ App,” said Srikanth.

A white label app is a product which is developed by Company X and is then rebranded as that of another company. It would seem that the app or the service, in this case, would be of ‘Udhaar Loan’ or ‘Go Cash’ or ‘Snapit Loan’, but they are, in fact, offered by Company X. Srikanth added that all the apps from the white label provider have their servers hosted on the Chinese company Alibaba’s cloud.

The modus operandi

These fintech apps advertise on social media, especially Facebook, luring people stating that the interest rate is only 0.98%. The interest rate sounds miniscule, but if these illegal digital loan apps charge 0.98% per day interest, it works out to an annual interest rate of 66%, which is almost double of the RBI-mandated upper limit of 36%. Moreover, in addition to the interest rate, the borrowers are always charged processing fees, and 18% GST.

“This is extortionate and illegal. Many states have state money lenders statutes, which even regulate informal money lending. Most of them impose interest rate ceilings which are in the range of 36%,” pointed out Kesari.

These illegal fintech app-based loans gained prominence because the money is transferred almost instantly, unlike other registered fintech apps. When these apps are downloaded, they mandatorily require access to your contacts, video and photo gallery. Once the access is given, you have to share your PAN card and Aadhaar details. The salary slip is not one of the documents that these illegal fintech apps demand.

As soon as the documents are shared, you are given Rs 3,000 and if you pay within a week and keep the loan rolling, the amount can go up to Rs 8,000 per week. The person can download several such apps to borrow a higher amount.

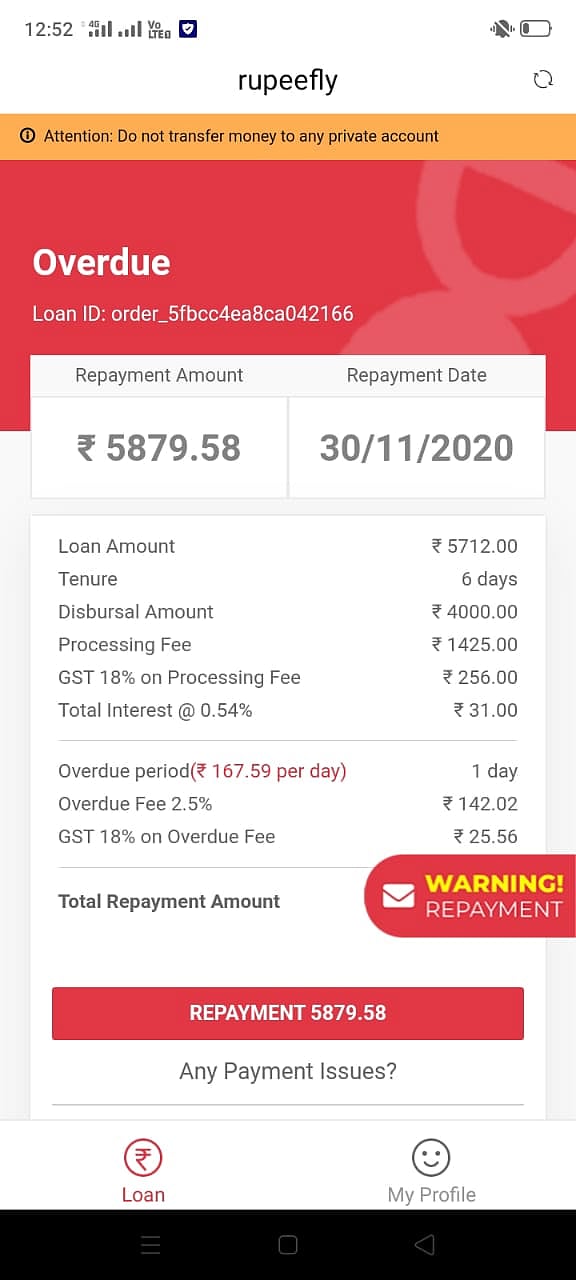

If the borrowed amount is Rs 4,000, you are required to pay back Rs 5,712, where the processing fee is Rs 1,425, GST on the processing fee is Rs 256 and the interest amount is Rs 31. If the payment is delayed by even a day, an overdue fee is charged. Unlike NBFCs or bank loans, where the processing fee is charged only the first time, here the processing fee is charged every week, for as long as the loan is active.

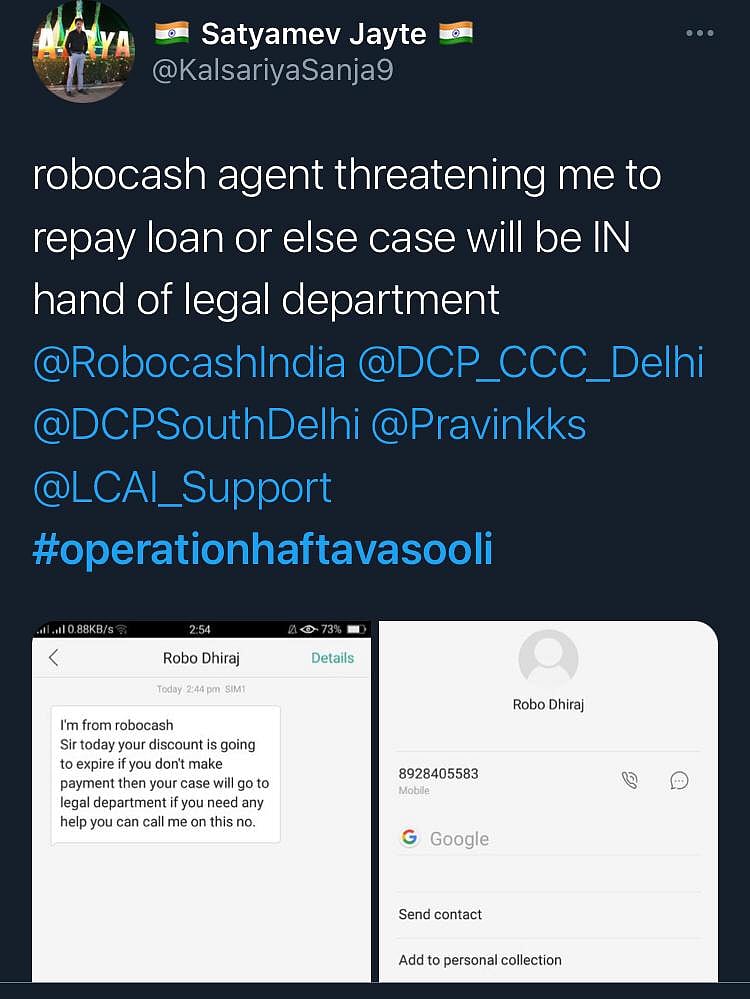

During the pandemic, as debts have risen, the app representatives have turned nasty as both Ajith and another businessman Rajeshkumar KR found to their horror. Several borrowers have posted their experiences using the hashtag #OperationHaftaVasooli on both Twitter and Facebook.

Rajesh delayed his payment due to technical issues. He spoke to the app representative, who assured him of a day’s extension. “Less than four hours after the call, the fintech app managers accessed my contacts, created WhatsApp groups with all of my contacts. They sent abusive messages to all of them. As I had figured their plan, I sent a message to all my contacts that my phone had been hacked. All of them exited the group,” said Rajesh. All of this was for Rs 5,000.

The incident enraged Rajesh. “I did not give them permission to misuse my contacts or photos. Moreover, I had requested for a day’s extension and they had agreed to it. I have always repaid the amount. As this pertained to fintech apps, I complained to the RBI, cyber police and the ADGP’s office,” added Rajesh.

He sent screenshots of these emails to those app representatives. As soon as they saw it, they exited from the groups and began sending him threatening messages. They said a recovery team would be sent to his home, an FIR would be registered, his bank account would be blocked, and his credit score would be slashed. “I have decided I will not pay now. Moreover, they cannot block my bank account or file an FIR as they are running these apps illegally. There do not have physical offices and are not in Kerala. The calls come from Gujarat, Haryana and Uttar Pradesh numbers. The speakers know only Hindi and broken English,” underscored Nair.

What can Google do?

Google's policies state that if any app "contains or promotes financial products and services", it must comply with state and local regulations for any region or country. The app is also required to provide a valid email address and contact details, none of which these apps seem to have. The company states that they do not allow apps which promote loans which require repayment in full in 60 days or less from the date when the loan is issued. Google terms such loans ‘short-term repayment loans’.

“Many of these apps are against the Google Playstore guidelines. They prohibit apps which lend for less than 60 days. In case of these apps, the lending period is mostly six days,” highlighted Kesari.

After receiving several complaints, Google had recently taken down Ok Cash, Go Cash, Flip Cash, ECash and SnapItLoan. But, they are all back in different avatars.

Does the government know?

As several people from Tamil Nadu were affected, DMK MP Dr S Senthilkumar wrote to Union Finance Minister Nirmala Sitharaman on November 16, 2020 about these rogue online apps. He hasn’t got a response yet.

“Nationalised banks take months to approve loans. Taking advantage of this, private lenders arrange loans at higher interest rates online. The Covid-19 pandemic has forced people to go for these loans and the loan representatives are harassing individuals driving them to the point of suicide. The Finance Ministry must ban these apps and instruct the RBI to monitor such apps online,” said Senthil kumar.

Kerala MLA PV Anvar wrote to the state Chief Minister about the north-India based illegal fintech apps, highlighting the situation of a woman in his constituency who lost around Rs 2 lakh due to these apps. Within Nilambur Panchayat, 25 others have faced severe harassment from the representatives of these fintech apps.

RBI is aware of the mushrooming of these apps as in June 2020, the Central bank had come up with a list of measures that these fintech apps had to follow. It had come up with these guidelines after receiving several complaints about exorbitant interest rates, non-transparent methods to calculate interest, harsh recovery measures and unauthorised use of personal data.

A PIL has been filed in the Supreme Court by Mumbai-based Pravin Kalaiselvan in this matter and is likely to come up for hearing on December 14.

Srikanth believes the only way to reduce the effectiveness of these rogue apps would be awareness, better regulation and increased digital literacy. “We need to have more informed consumers who understand the differences between rogue apps and legit ones. Platforms like Google, too, need to strengthen their app store policies so that these apps do not make it to the top of their Play Store list,” he added.

National Herald emailed questions regarding these fintech apps to the RBI and the Finance Ministry, but did not receive any response. This article will be updated if they respond.

While the government is attempting to promote Digital India and as a part of it the cashless framework, there isn’t sufficient digital literacy to prevent such instances from occurring. There is high coercion to give data to the government, as seen in the Aadhaar drive, along with the demonisation of privacy as elitist, so people have normalised giving private data without realising if it is required or not. As a result, digital security and literacy haven’t reached the masses, while digital coercion has. Most people who download these apps would not know enough to differentiate these illegal online apps from legitimate lenders.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 08 Dec 2020, 7:45 PM