Fallout of Modinomics: favoured cronies growing faster at the expense of others

Government prints money to fund six-lane highways and Bullet trains. Savings and investment are declining but wealth 'creators' favoured by Govt are growing faster than ever, explains Sonali Ranade

Can activities like assembling cell phones with imported chips set off economic growth?

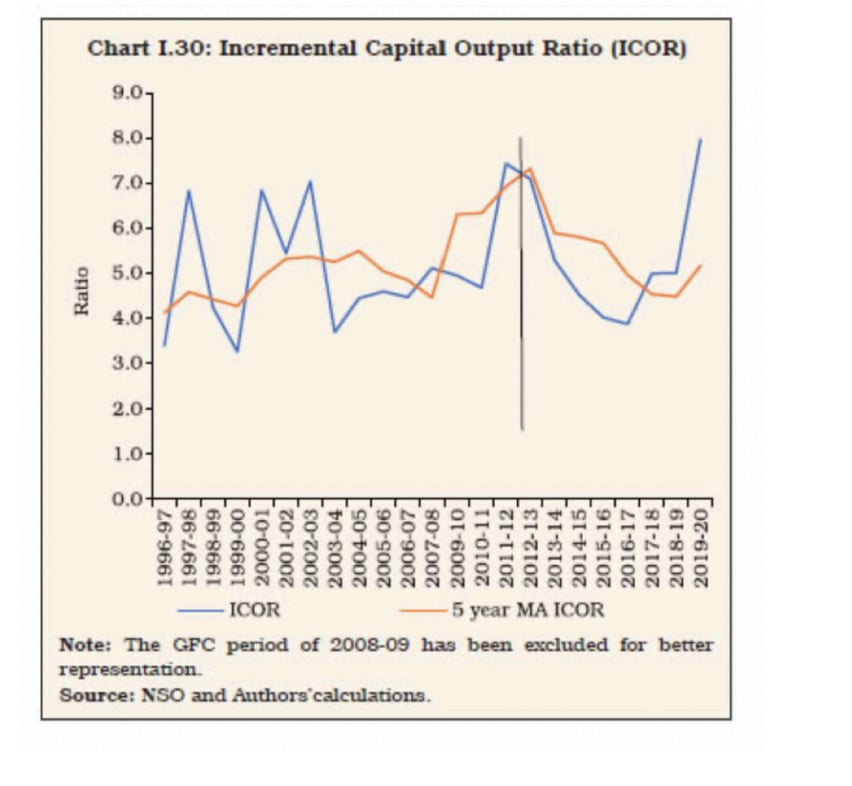

The Gross Domestic Savings [this includes significant dollops of FPI + FDI as well, though not what comes in incrementally,] Gross Capital Formation or Investment in the economy together with Consumption by both consumers and the Government provide the answer. The growth produced by a unit of additional investment, the so-called Incremental Capital Output Ratio or ICOR estimates what can be done with existing resources in the system.

Very little survives Modinomics.

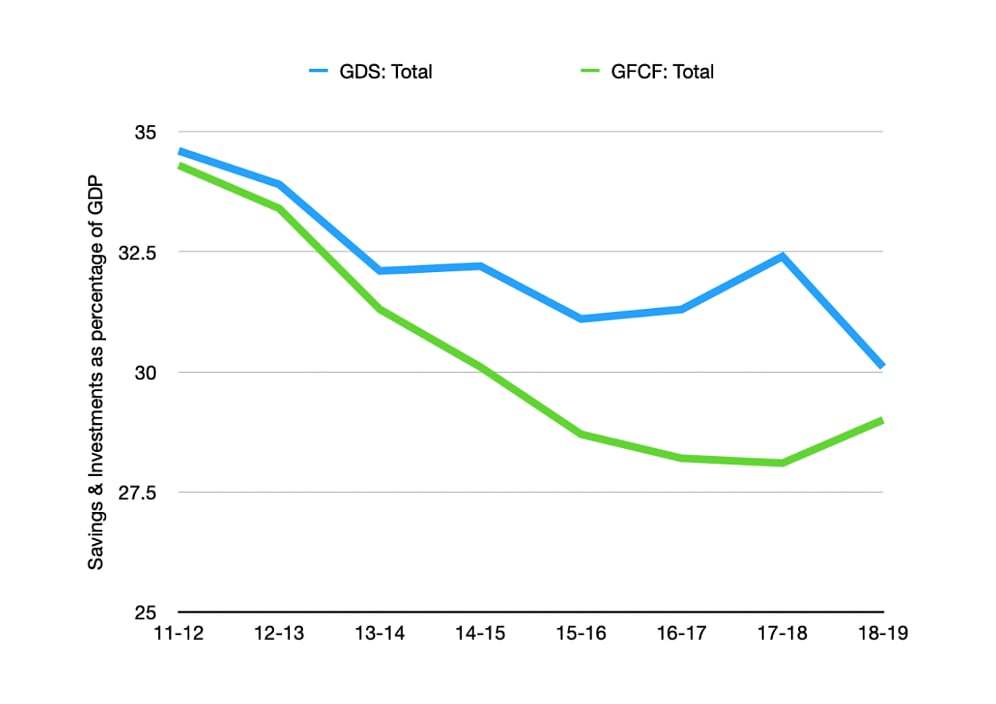

Gross Savings in the economy [GDS: total] declined from 34.6% in 2011-12 to 30.1% in 2018-19. Later numbers aren’t available but will surely have tanked further below 30% of GDP.

Correspondingly, the total investment rate, private sector plus Govt. or public sector, has also tanked from 34.3% of GDP to 29%.

Since 2017-18, Modi has tried to crank up public sector investment - lots of money going into bullet train and 6 lane highways and metros—in order to step up growth, but with little result. Metros is a very productivity enhancing service but the same isn’t true of 6-lane highways despite their good looks that invites jets to land on them.

This has cranked up Government debt but produced little growth. Worse, combined Govt. debt having ballooned from 67% of the GDP to 90%, Government’s credit rating is now just one notch above junk in global markets.

Taking all these factors together, it can be said that Modi has hit the end of the road as far as using public debt to finance the splurge on 6-lane highways for the Hindutva hinterland is concerned. Luckily, Modi hasn’t added to the bullet trains on order for diamond polishers from Ahmedabad to save on fees paid to Angrias.

Within the overall savings investment scenario lie many disquieting trends that will hamper future growth as availability of debt becomes an overriding constraint on investment.

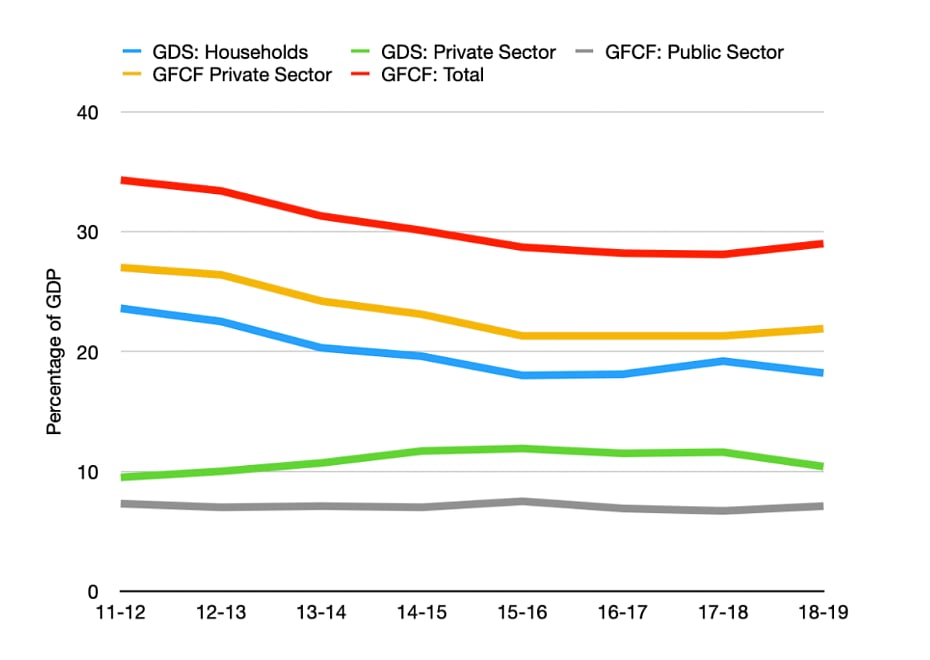

Here is the graph of household savings, private sector savings, which are actually plowed back profits, and private and public sector investments. [Don’t be fooled by “public sector investments.” More often than not this is printed money sloughed into 6-lane highways & nothing else.]

The graph looks cluttered but is very simple to read. The red line is the total investment in the economy, both by the private sector and the Government. This is called Gross Capital Formation or GCF, and represents new investments made in the economy.

If ICOR is 5, each unit of GCF produces 1/5 or 20% incremental output 0r 1% growth in GDP in subsequent years. So, if GCF is 30% of existing GDP, it will produce a 6% GDP growth [one fifth of 30% GDP] in subsequent years.

Since GCF captures all of the investments in the economy - domestic plus those coming from FPI + FDI, - this is the maximum rate that the economy can grow at, provided it is operating at full capacity. This is the economy’s Alpha component of the growth rate.

The Beta comes from changes in capacity utilization, and can be negative or positive. The total growth is Alpha plus/minus Beta.

Here we are concerned only with Alpha, that is the long-term potential growth, assuming an ICOR of 5.

[ICOR itself is a wild animal that zooms from 3 to 7 in any given year. Here I am assuming 5 because that is the 5-year moving average of ICOR estimated by an RBI paper published recently. The graph shown above is from the said RBI paper.]

And so, remember this take away. In the best of existing worlds, India’s alpha, given ICOR of 5, and savings rate of 30%, is 6% per annum.

There is not a chance that we can better that rate under the present policy regime.

Given the inefficiencies of the system and the recurrent exogenous shocks that reduce Alpha, my guess would be that we can grow on our own steam, with current level of borrowings from abroad, [that’s FPI, FDI, NRI deposits and net loans from abroad] at no more than 5 to 6% per annum at the most.

There isn’t a snowball’s chance in hell of our catching up with China under the present policy regime.

Is Govt. solvent with an Alpha of 6% per annum?

The question is, even if we assume that we desire no more than 6% growth per annum under the present policy regime, is the Govt. solvent enough to carry on at this rate of growth indefinitely? Or can the Govt. be pushed into bankruptcy by a ruthless China using nothing more than a few more adverse trade moves?

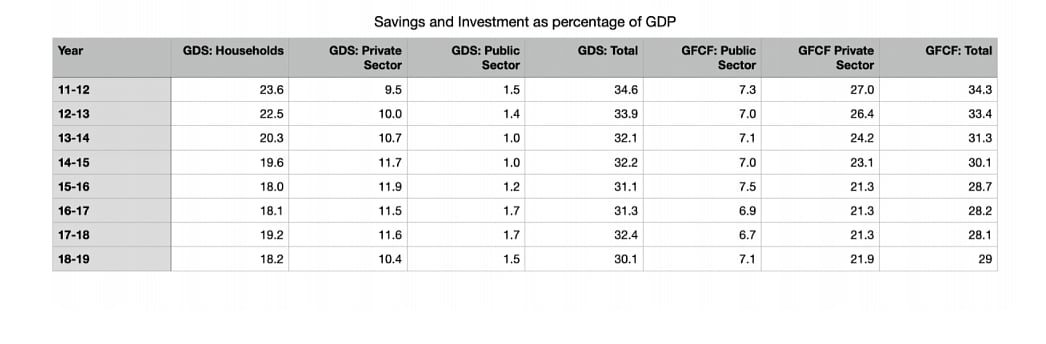

To understand this conundrum, let us look at the savings, investment scenario in a wee bit more detail. The following table will help.

Household savings, has been trending down for over two decades, and is currently at 19% of the economy. [I am taking a median number and not the pandemic induced crisis number.].

Out of this about 60% is in bank deposits, mutual funds and other financial instruments that flow into the economy, and are available as source of investable funds to private sector & Govt. The balance 40% are fixed assets like Gold and real estate, that represent end use, & are no longer in circulation. So, households provide, 11.4% of GDP as money for investment to the private sector and Govt.

The private corporate sector “saves” [its plowed-back profits plus depreciation etc.] another 11% of GDP, while it invests about 21% of GDP. So, it needs to borrow about 11% of GDP to be able to invest what it takes to produce a 6% GDP growth rate. Household savings being 11.4% of GDP, all of household savings are already fully exhausted by private sector demand.

What of the public sector and/or Govt.? As you can see from the table, the Govt. “saves” about 1.5% of the GDP and claims to “invest” 7% of GDP. [The claimed “investment” of 7% of GDP is bogus as it includes borrowings to pay everything from babu salaries, interest on Govt., debt, and even subsidies to corporates and the poor. The investment is fiction except for 2 to 3% of GDP on infrastructure, but borrowing is real.]

So, the Govt. needs to borrow at least 5.5 to 6% of GDP in a market where there are no surplus financial savings to be had. You could say that the 40% household savings in physical assets could be monetised, but then why should households borrow against those assets to lend to the Govt. at a rate far lower than the cost of their borrowing?

The long and short of it is that even the 6% Alpha that we calculated here is unsustainable at the current rate of gross savings of 30% of GDP. If nothing were done, even a continuation of existing policies would only see Alpha fall back to the 3 to 4% old Hindu rate of growth of the seventies and the eighties. The future under the current policy regime is very bleak.

Domestic Champions unable to help us grow faster

The thinkers on the economic right of the Indian Polity believe in the “robber-baron brand of capitalism”, which they expect would produce the initial dollops of Capital needed to grow rapidly.

This myth refuses to die even in the face of modern macro-economics, where the Gross Domestic Savings number captures all the savings produced in the economy from which comes the Capital for investment. The robber-barons don’t produce additional savings over and above this number out of thin air for investment.

Modi on the other hand has revived the traditional King-merchant alliance that has prevailed over the past centuries. In this model, political and economic power combine to create a large pool of cheap labour at the bottom of the income pyramid, [that was the economic function of the caste system, and still is] to enable the elites to live in relative luxury, even as the gullible chase their mythical karma by following their delusional dharma.

Be that as it may, the first thing to note is that domestic champions bring no additionally to the savings rate of 30%. That pool of savings includes everything that can be saved. They only borrow from it. Or preempt savings coming from abroad as Reliance recently did, grabbing what was earlier destined for a standalone refinery in a joint venture with KSA. So, champions or not, the alpha cap of 6% remains, even if the Govt. stays solvent, which it cannot.

So, what is the fatal attraction of the Domestic Champion model? Especially for right wing politicians and their hangers on?

Remember if you are a favoured Adani or Ambani, or X or Y, Govt. favours mean you grow at the expense of others. So, while Savings may remain at 30% of GDP, ICOR at 5 and alpha at 6%, your share of the 30% of savings grows much faster than that of your competitors, and therefore, your possible Alpha is much higher than 6%.

You grow much, much faster than the rest of your competition, and so long as the favours keep coming, a portion can be safely & profitably be employed to keep your favorite politician in power through anonymous Electoral Bonds. What used to be good old corruption, becomes a legitimate social norm of producing an orderly society by contributing election funds to a political party. The nub that Pratap Bhanu Mehta called “structural corruption.”

That is the true nature of the Kautilyan King-Merchant alliance which used to put prominent merchants as nobles in the Kings innermost privy council.

But as I said, argue any which way you want, domestic champions produce incremental growth only for themselves, at the expense of their competitors but bring no additionally to Alpha for the economy as a whole, which alone determines whether you will catch up with China or not.

So, under what circumstances, or mix of policies can domestic champions contribute to Alpha in order to beat the 6% per annum imperative?

This can happen only when the domestic champions become world champions and start exporting an incremental 40% of their total output on a net basis [meaning their exports minus imports should be at least 40% of their turnover].

But curiously enough none of the chosen merchants is a significant exporter on a net basis; not even Reliance when you deduct the cost of imported crude from its diesel & petrol exports to arrive at net exports.

And remember the GDP equation. Only net exports contribute to GDP.

This isn’t coincidence. A net exporter, and global champion at that, would need no favours from the Government. They could dictate their terms of engagement. So, merchants craving Govt. favours don’t usually have significant exports.

That’s why the exporting community doesn’t line up to donate to anonymous Electoral Bonds.

(The writer is an independent trader. Views are personal)

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines