Tax breaks given to corporates by Modi govt led to severe resource crunch for ministries

The squandering of revenue opportunities by Modi government merely to appease powerful interests led to heavy costs for people during the pandemic

In 2019, barely four months after the general election, the Central government announced a reduction in the corporate tax rate from 30 per cent to 22 per cent. It also announced a special low rate of 15 per cent for new corporations.

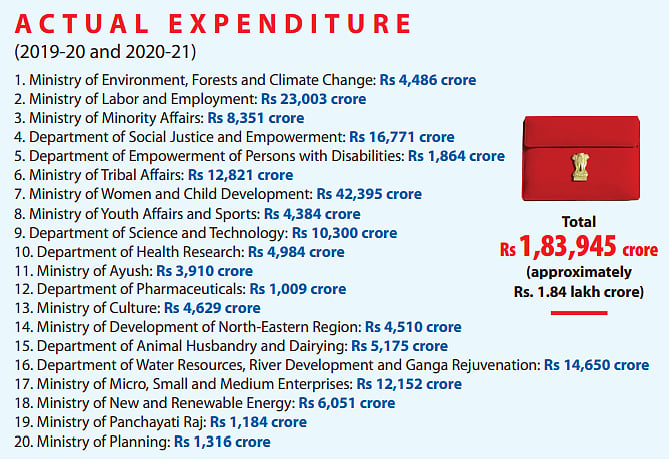

The Estimates Committee of Parliament recently confirmed that the corporate tax cut had led to a revenue loss of Rs. 1.84 lakh crore to the public exchequer in the two years—FY2019-20 and FY2020-21— without any increase in either investment or employment.

The cut in corporate taxes was announced in September 2019 just before the Howdy Modi event organised in Texas (USA), where the Prime Minister Modi, in a digression from the standard protocol, called upon Americans to re-elect Donald Trump as President ('Ab Ki Baar Trump Sarkar').

What if the government had not announced the tax cut? It is known now that despite the pandemic which resulted in slowing down production and actually reduced employment, corporate profits did not go down. The profits actually increased against all odds and the personal wealth of Indian dollar billionaires went through the roof. The number of dollar billionaires also went up from 134 in 2019 to 177 in 2021.

Arguably, therefore, there was no justification for the corporate tax cut by way of incentives in the hope that it would boost investment, production and employment. It merely helped rich corporates become richer.

Ironically, the tax cut was announced even as the government was complaining of resource constraints. Less than adequate allocations were made for important welfare schemes and some of the social sector expenditures were actually reduced.

With the PM waxing eloquent on freebies and the ‘revadi’ culture, it needs to be asked how the government would classify the corporate tax cut given on a platter. What is evident, however, is that this amount would have substantially helped augment the budget of important ministries and welfare schemes.

A rough calculation shows that the allocations of as many as 20 ministries and departments could have been doubled if the corporate tax had been collected at the old and existing rates.

In the table, the expenditure data has been taken from the expenditure profile for two years provided by the Budget Division of the Ministry of Finance.

In the last few years, resource constraint has affected several schemes of the Ministry of Women and Child Development, Ministry of Labour and Employment, Ministry of Tribal Affairs, Ministry of Minority Affairs, Department of Social Justice and Empowerment and Department of Science and Technology. This could have been avoided if the government had not been extravagantly generous to corporate India.

The lesson for the future is that in situations of severe resource constraints, revenue opportunities should not be squandered merely to appease powerful interests. The costs for people can be very heavy, as was seen during the pandemic which followed the tax cut.

(The writer is honorary convener, Campaign to Save Earth Now)

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines