Tweaking five rules from tenancy to tariff may help revive the informal sector

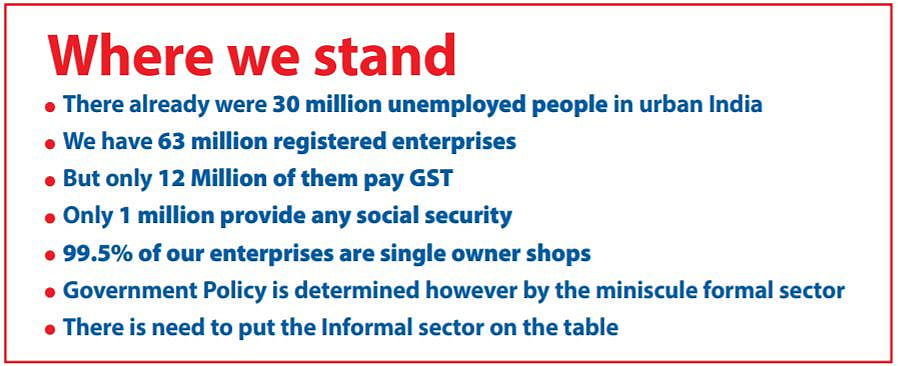

Like it or not, Indian economy is largely an informal economy. We have 63 million enterprises but only 12 million pay GST and only one million provide some sort of social security to workers

Recently, a cartoon strip in a US newspaper had two unemployed youth talking to each other, “Still unemployed?”, asked one to another.

“Yup, employers just can’t compete with my current salary of food stamps and unemployment checks”, replied the other.

The problem for India is even more grim as we don’t have a social safety net for people who have been rendered jobless due to COVID-19.

Also, as we open up, we may not be able to provide jobs as even before the pandemic and the lockdown, India’s formal economy was no longer adding any jobs and the bulk of employment was being created by the informal sector in urban India.

By some estimates there is a backlog of 30 Mn people in urban India waiting to be employed. While the news cycle is replete with the migrant crisis, there is a looming job crisis in urban India which also needs attention.

India has 300 Mn workers in urban India whose jobs - like those of sales personnel at the deserted shops, waiters at the empty restaurants and housekeeping staff at now WFH (Work From Home) offices - may be at stake as many of the businesses would never open up and even if they open up, the demand will remain muted.

While there is hope that the formal sector would rise to the occasion, the fact of the matter is India’s formal sector is very small: India has 63 million enterprises but only 12 million pay GST and only one million provide any social security.

Demotivating as it may be, for the vast majority of Indians in urban India with limited education and skills, the only hope in this crisis is to either find a job or to be self-employed in the informal sector.

The connotation of working in an informal setup is not inspiring but the Informal sector has been an integral part of India - producing 50% of India’s national domestic product and providing jobs and skills to millions of first-time workers.

However, 99.5% of our enterprises are single owner shops as they prefer to remain small to avoid taxes.

Relaxing some policies can enable these businesses to scale up and provide jobs to people who got wiped out overnight from the job market. While companies in the formal sector absorb large workforce in certain clusters, the informal sector is present across India and can provide employment in far flung areas, thereby even solving for the migration problem partly.

The informal economy is not as draconian as it has been portrayed, in fact it is complementary to formal enterprises. Income from the informal sector is mostly spent in the formal economy and it boosts demand for formal goods. It provides on the job training and alleviates pressure on the state during times of reduced public spending.

The sector offers flexibility, especially important for women who remain responsible for child-care. Lasly, many of the formal enterprises often outsource their work to informal enterprises to keep costs in control.

Keeping this in mind, the Government must take a sympathetic stance and relax policies which can aid informal urban entrepreneurship. To start with, policy makers should take an inclusionary, rather than exclusionary approach to the urban informal economy by integrating the informal sector into city planning, budgeting and financing.

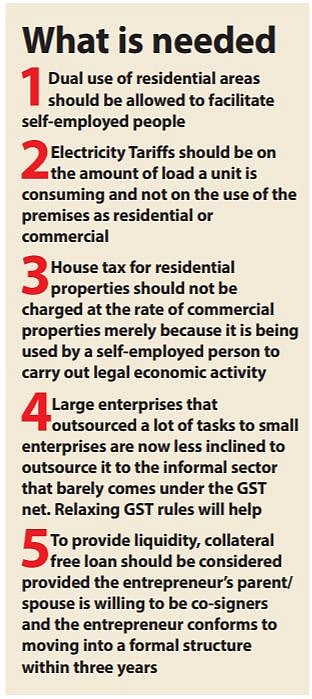

First, policymakers should allow dual use of residences to facilitate self-employed people to work from home. Of course, this is not a license to operate a mining excavator from your home but work done withiin reasonable limits should be allowed.

Often working from an unauthorised area automatically disqualifies an entrepreneur from joining formal channels of finance and Government support. As a result, they are confined to operate at a sub-optimal level and never grow beyond one employee, which is the owner himself.

Electricity Tariffs also need to be relooked, as for commercial use they can be 50 to 200% higher than a residential connection. Rather than discriminating the tariffs on the type of premises, it should be on the amount of load a unit is consuming. Higher slabs of consumption should invite higher tariffs.

House Taxes also inhibit the growth of home-made-entrepreneurs. Urban local bodies (ULB) impose higher tax and penalties from the date of occupation if any commercial activity is spotted in a residential area. Hence, landlords hesitate to let out their properties to the self-employed people.

To provide liquidity, micro amount collateral free loan should be considered, provided the entrepreneur’s parents/spouse is willing to be the co-signer and the entrepreneur conforms to moving into a formal structure within three years of beginning the operation.

Above initiatives will help scale the informal sector but to ensure they can source work easily, we also need to relook at GST.

Large enterprises that outsource a lot of tasks to small enterprises are now less inclined as the informal sector does not come under the tax net. Relaxing some of these rules may restart the economic engine as it will help under-stress formal units to source goods at a low cost from the informal units and in exchange may also provide on the job apprenticeship to them. Our mindset lets large enterprises have a disproportionate influence in policy making, with no place for the informal sector on the table.

It is important we get these policies right so we can put our demographic dividend to use which is now staring at us and asking us for our support. Countries become self-reliant when its people become AtmaNirbhar.

(The author is a management graduate from IIM-Calcutta and a freelance writer. Views expressed are personal)

Also Read: India’s economy is in deep trouble: S&P

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines