Why are banks collecting information about customers’ religion and political connections ?

Why are banks collecting information about customers’ religious and political affiliations? While not all banks seem to be engaged in this exercise, the forms of some banks seek such information

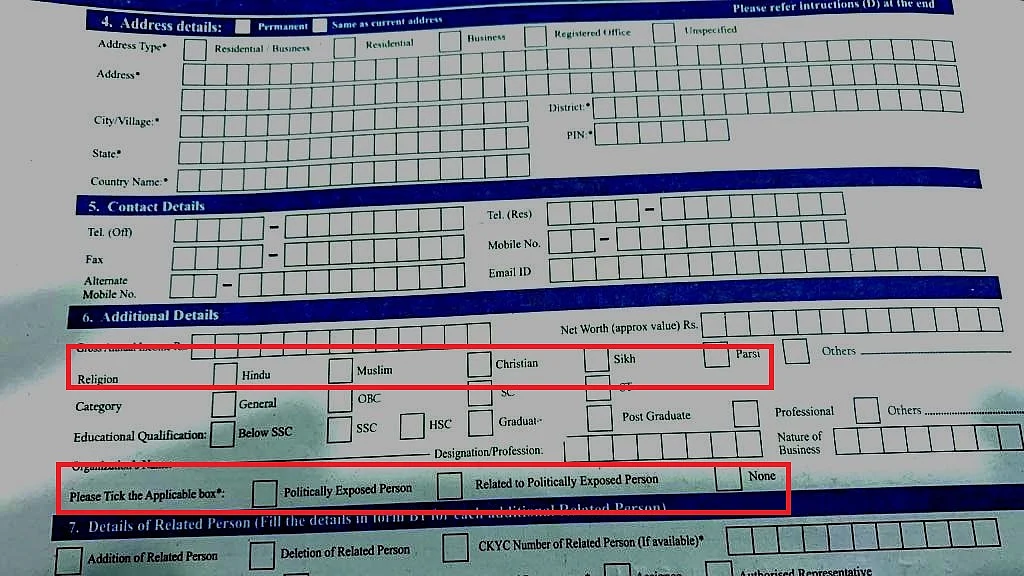

Surprise, Surprise!! Bank Account opening forms are now, in New India, asking not only about the applicants’ religion and caste but also ‘Political Exposure’. Wonder if DBT, Jan Dhan and all will be disbursed on such parameters!! Is the RBI behind all this?” tweeted former Member of Parliament Tathagata Satpathy this week and immediately caused a stir.

The former MP from Odisha clarified that it was a form issued by the Central Bank of India, a PSU bank, which asked customers to record their religion among other things and also asked whether they are “politically exposed person” or not.

Now, why would a bank need to know the customer’s religion? And what does it mean by “Politically Exposed Person”? Will these be the grounds on which loans would be sanctioned, wondered the former MP.

Central Bank of India’s ‘Customer Information Form’ for new individual customers, available on the bank’s website, indeed asks about religion on page number 3 under ‘personal information’. But we could not find any mention of political inclination. Is it possible that the bank issued a different set of forms as a trial balloon? While it could have been asked to test the water, it is also not clear if customers can refuse to part with such information.

The State Bank of India’s KYC application form in Section C under the heading ‘Other Details’, however does ask if the individual is a Politically Exposed Person (PEP) or related to a PEP. Either option has to be ticked, if applicable. The form doesn’t ask for religion though.

ICICI’s ‘Know Your Client Form’ is shorter than both Central Bank and SBI and doesn’t have any question on religion or political exposure. Punjab National Bank’s KYC form asks about religion under the heading ‘optional’ information but doesn’t ask about political exposure.

In July 2008, RBI issued regulatory guidelines on KYC norms, along with anti-money laundering and combating financial terrorism norms which mentioned that accounts of “politically exposed person” should be opened after higher level of scrutiny and decision should be taken by a higher authority, sources of funds should be investigated, and such accounts should go through enhanced monitoring on an ongoing basis.

Who is a politically exposed person?

According to the RBI guidelines, “politically exposed persons” are individuals who are or have been entrusted with prominent public functions. It mentions senior politicians, senior government/judicial/military officers, senior executives of state-owned corporations, important political party officials etc.

The Securities and Exchange Board of India (SEBI) in its circular dated December 19, 2008, mandated mutual fund companies to capture information on whether an investor is politically exposed person.

In 2015, the Insurance Regulatory and Development Authority of India (IRDAI) also directed all insurers to ensure appropriate risk management procedures for identifying and applying advanced due diligence measures to PEPs.

It may be concluded that Indian banks are not required or mandated to ask citizen’s political affiliation or ideologies. Only the non-resident Indians who wish to open bank account or invest in India are required to disclose if they are politically active in foreign countries.

In December 2019, soon after the Citizenship Amendment Act (CAA) was passed, media reports surfaced to suggest that banks may introduce a new column in KYC forms seeking depositors and clients to mention their religion. It was assumed that such a requirement arises in the wake of the changes made to FEMA Act regulations, which extend the benefits of opening NRO accounts and holding property to select religious minorities, excluding Muslims.

The RBI amendment to FEMA was strongly condemned by Financial Accountability Network India which called the move “communalization of banks”.

“At a time when the banking sector is unable to come out of the crisis that it is already in, this is a well-designed and planned move to further divide the secular country. Moreover, this move also indicates the willingness of RBI to be used as a political tool of the government,” the statement said.

Calling the move ‘unconstitutional’ the statement added, “This is the first time that banks are introducing religion as a criterion for any banking activity and must be steadfastly opposed. It is deplorable that RBI is lining with the communal agenda of the government…”

But such speculations were rejected by the Finance Ministry. The then Banking and Finance Secretary Rajiv Kumar, in a tweet, had said: “There is no requirement for Indian citizens to declare their religion for opening/existing Bank account or for KYC. Do not fall for baseless rumours about any such move by Banks.”

A simple look at some of the bank forms available online presently however would reveal that banks are indeed asking for information on religion.

So, what is cooking in the holy land?

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines