Congress alleges SEBI 'reluctant' to probe allegations against Adani group, renews demand for JPC

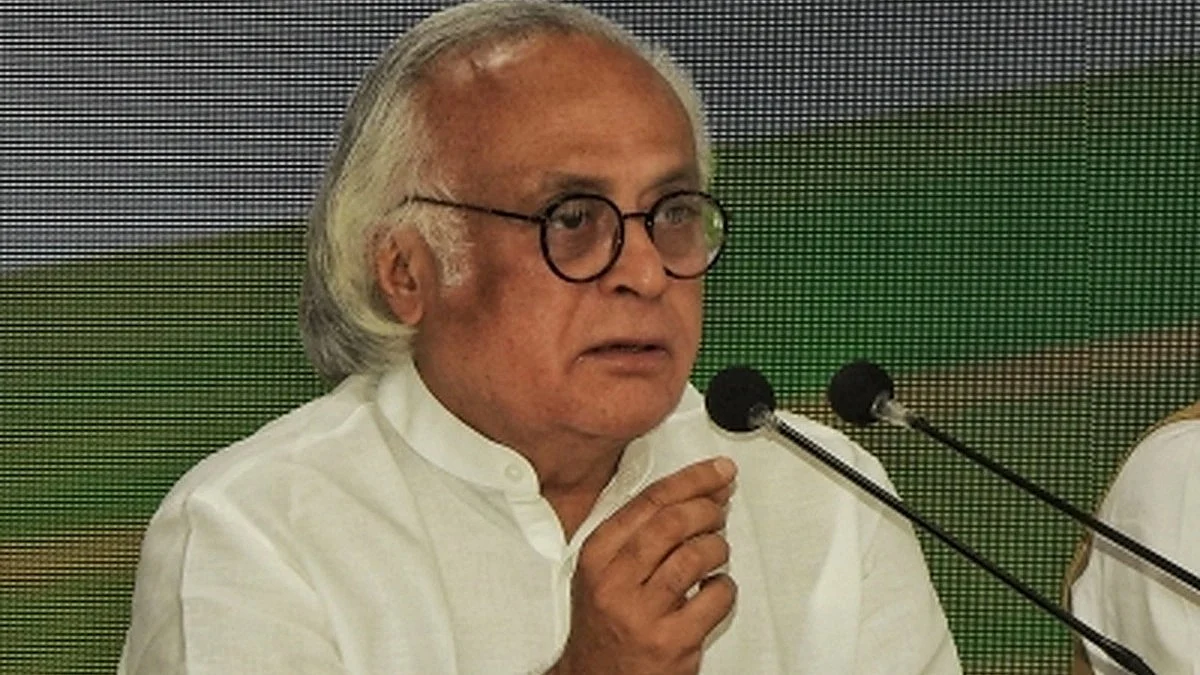

Congress general secretary Jairam Ramesh cited a media report to say that the "stench of illegality" around another Adani-linked shell company - Opal Investment - is getting stronger

The Congress on Wednesday alleged that the SEBI is "reluctant" to investigate the allegations against the Adani group and said the only way forward is a joint parliamentary committee probe to bring out the truth.

Congress general secretary Jairam Ramesh cited a media report to say that the "stench of illegality" around another Adani-linked shell company - Opal Investment - is getting stronger.

He claimed there are "fresh revelations" that the firm, which controls Rs 8,000 crore worth of equity in Adani Power, was set up as a “single person company” in Dubai in May 2019.

"This raises several serious questions. How does a single-person firm based in Dubai come to control 4.7% of equity worth Rs 8,000 crore in Adani Power, India’s largest private power generation firm? Is Opal not yet another Adani front engaged in illegal round-tripping and blatantly violating Indian securities laws," he asked in a post on X.

"And why is it doing so, whose funds are these actually? What are PM Modi’s retirement plans after May 2024," he also asked.

He said the "glacial and reluctant" SEBI investigation doesn’t seem to be producing any answers and renewed the Congress' demand for a JPC probe.

"The only way forward is a JPC that investigates the full story behind the mega Adani Scam," Ramesh said while tagging the news report.

The Congress has been demanding a JPC probe into the allegations of "stock price manipulation" and financial irregularities against the Adani group made by US research firm Hindenburg that the Adani group has denied as baseless.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 27 Sep 2023, 4:15 PM