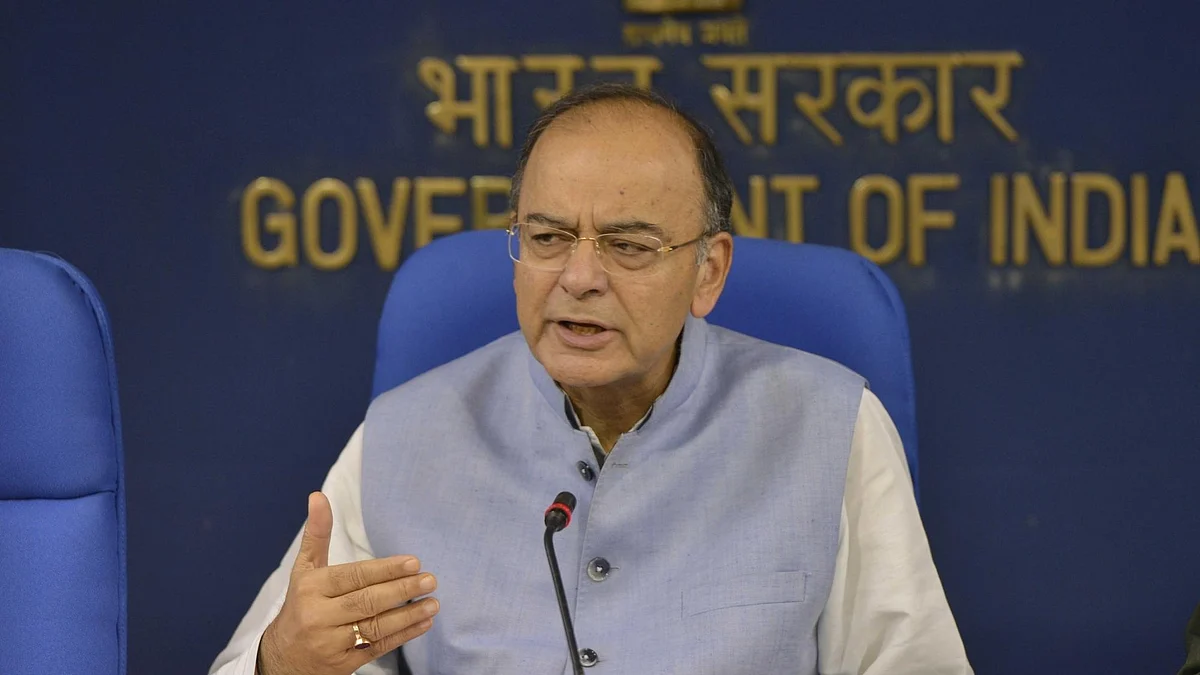

Jaitley toys with Income Tax relief for the middle class in interim budget

Besides sops for farmers, loan waivers and announcement of plans like the Universal Basic Income, the Govt appears to be contemplating an increase in Income Tax threshold to appease the middle class

With middle-class apathy on the rise, Finance Minister Arun Jaitley may double the income tax exemption threshold for the salaried from the present ₹2.5 lakhs to ₹5 lakhs while also reinstating tax-free status for medical expenses and transport allowance, providing some relief to the section already under strain since demonetisation.

Though propriety demands that not too many policy changes should be made in a vote on account budget, the BJP government is apprehensive of the possibility of a middle-class backlash in the impending general elections.

Hence the plan to streamline tax slabs, which in any case are in consonance with the coming Direct Tax Code, government sources said.

The problem that may manifest itself is that the Union Budget will precede the unveiling of the Direct Tax Code Report on February 28. Tinkering with the tax rates before the release of the report will make it contentious.

The new Direct Tax Code will try to bring more assessees into the tax net, make the system more equitable for different classes of taxpayers, make businesses more competitive by lowering the corporate tax rate and phase out the remaining tax exemptions that lead to litigation. It will also redefine key concepts such as income and scope of taxation

At the moment, income up to ₹2.5 lakh is exempt from personal income tax. Income between ₹2.5-5 lakh attracts 5% tax (see table), while that between ₹5-10 lakh is levied with 20% tax. Income above ₹10 lakh is taxed at 30%. ₹5 lakh exemption is only applicable to individuals of over 80 years.

Also, tax free medical expenses up to ₹15,000 and transport allowance up to ₹19,200 per annum has been replaced with a ₹20,000 standard deduction for those earning above ₹5 lakh last year. This will benefit tax payers to the tune of ₹12,500 annually which is not much but can be viewed as a sentiment buster.

A fatigued BJP dispensation realises that as the incumbent it will have to fight off varied challenges.

With acute farm distress, middle class backlash, massive spike in unemployment data and rising Dalit anger taking its toll on the BJP, it would like to unleash a slew of course correctives. The 10 percent quota for upper castes was part of this process to appease vote banks. But this was an executive decision adopted by parliament, tinkering with the tax structure similarly is a legislative decision.

Income Tax Slabs for Individual Tax Payers & HUF (Less Than 60 Years Old) for FY 2018-19 -

Income Tax Slabs Tax Rate

Income up to ₹2,50,000* No tax

Income from ₹2,50,000 - Rs 5,00,000 5%

Income from ₹5,00,000 - 10,00,000 20%

Income more than ₹10,00,000 30%

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines