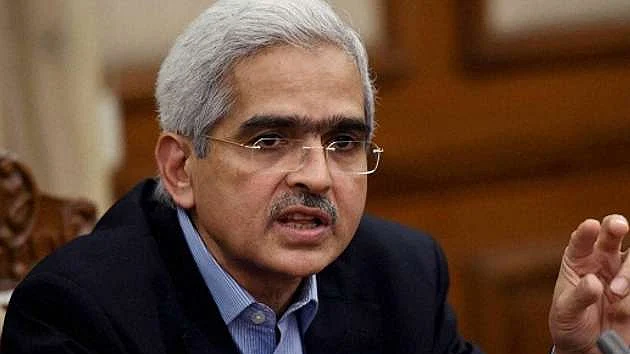

RBI Governor Shaktikanta Das launches UPI payments for feature phones and helpline for digital payments

The UPI 123 PAY launched on Tuesday will help take the digital payment ecosystem beyond those who use smartphones, payments through which have emerged as a popular mode

Reserve Bank of India (RBI) Governor Shaktikanta Das has said that the day was not far when transactional volumes in India would reach Rs. 100 Lakh Crore on Unified Payments Interface or UPI. Pointing to how a digital payments ecosystem had flourished in the country, Das observed that the current decade will witness a transformative shift in the digital payment ecosystem in our country.

Doubling its position from a year ago, 453 Crore UPI transactions worth Rs. 8.26 lakh Crore were recorded in February 2022.

The Governor was speaking at the launch of RBI’s UPI 123 PAY for feature phone users and a 24x7 helpline for digital payments called DigiSaathi. The two products are diverse yet significant dimensions of the digital payment ecosystem. “For the financial year ending March 2021, the total value of transactions done on UPI, I am told, was about Rs. 41 Lakh Crore. And for the current year, till today, I have been informed that the total volume of transactions is Rs. 76 Lakh,” Das said.

The UPI 123 PAY launched on Tuesday will help take the digital payment ecosystem beyond those who use smartphones, payments through which have emerged as a popular mode. UPI 123 is designed for feature phone users who will also be able to now make digital payments through three steps. The RBI believes that this will allow 40 crore feature phone users in India to access the payment service. Feature phones have limited access to innovative payment products as they are basic and do not have access to the internet like smartphones.

Developed indigenously, initiatives launched today have the potential to deepen the digital ecosystem and financial inclusion. Some of the solutions launched are an outcome of the regulatory sandbox initiative which was launched by the Reserve Bank in 2019.

UPI has been developed by the National Payments Corporation of India (NPCI), the umbrella organisation for all digital payments in the country. “As of now, the multifaceted features of UPI are mostly available to smartphones. But we also have a large base of feature phone users in this country, who primarily come from the lower rungs of the society in economic terms. In rural areas, there are people who are not in a position to afford a smartphone, notwithstanding the fact that smartphones have become considerably cheaper,” the RBI Governor said.

Das informed that the launch of UPI 123 Pay makes the facilities under UPI now accessible to that section of society, which was so far excluded from the digital payment landscape. “In that way, it is promoting a great amount of financial inclusion in our economy,” he said.

As regards DigiSaathi, Das said the helpline would help customers who need any clarification, if a payment is not going through, or if he wants to know to whom to make a particular kind of complaint, if he is encountering some difficulty. “The helpline is essentially for those who need help. It also has facilities for educating and creating awareness among the potential and the existing customers,” he said.

Currently available in Hindi and English, the 24x7 helpline will over the period of the next few months, be made available in other Indian languages as well. Das informed that the RBI had taken more than 50 initiatives in the last three years to deepen the digital payments ecosystem in our country. “Invariably, there would be three or four announcements relating to digital payments and promotion of FinTech in our country. Even intermittently, we have been taking other initiatives and announcing them as well,” he said. Das mentioned guidelines on interoperability, tokenisation, switch ON switch Off facility on cards, increasing the turnaround time for failed transactions, 24X7 availability of RTGS and NEFT, network access control, creation of payment infrastructure development fund, and similar other initiatives as major steps taken to promote digital payments in India.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines