NDA’s disinvestment history: Selling family silver to pay the butler

45 per cent of stake of Hindustan Zinc which the NDA govt sold to the Vedanta Group is today valued at Rs 40,000, 50 times of the sale price in 2003

Privatisation of PSUs by the erstwhile NDA-1 government led by Atal Bihari Vajpayee has proven, in retrospect, that family silver was sold to pay the butler. Soon after assuming office in 1999, the NDA-1 government embarked on a privatisation programme of central PSUs. In less than two and half years, the government sold off controlling stakes and transferred management rights in nine profit-making and asset-rich Navaratna central PSU companies to “strategic private partners”.

The buyers were mostly the archrivals and competitors of these PSUs. The government also made slump sale of 18 hotels at various important locations belonging to the public sector ITDC. There was clearly no ‘strategic thinking’ behind the strategic sale of PSUs. The government then was, and now is, broke.

The government, which did not know how to efficiently manage large PSUs, decided on a short-sighted solution to fix their finances. In some cases, even well-managed PSUs were sold to the private sector.

But a lot of strategic thinking had gone into these PSUs when they were established to strengthen the then weak industrial base of the country. It has of late become fashionable to discredit the state-led economic development model of the Nehru era. But in those days, private capital or entrepreneurship was not sufficient to make required investment. Several vital PSUs which played a stellar role in establishing India’s industrial base were thus handed over on a platter to private companies by Vajpayee government.

Sold for a song

The zeal and the speed with which nine PSUs were sold off to the private sector players were astonishing. The NDA-1 government earned a total of Rs 5,544 crore from the strategic sale of nine giant PSUs and ITDC hotels. Every single privatisation was controversial and attracted allegations from the workers’ unions that the PSUs were being sold for a song. Balco remains highly controversial to this date. There were allegations that the assets of the company were grossly undervalued. The valuation of the company’s assets, including the sprawling township, aluminium plant and a 270 MW power plant at Korba was completed in just 19 days. The 51 per cent controlling stake in Balco was sold to Anil Agarwal’s Vedanta Group for Rs 551 crore. With an investment of just Rs 551 crore, Vedanta Group got control over assets that were worth several times over.

Hindustan Zinc was the second largest zinc-lead miner in the world. The 26 per cent controlling stake in this metals major was sold again to Agarwal for a bid price of Rs 445 crore. As part of the ‘call option’, the government further divested another 19 per cent stake at the same price to the private entity in November 2003.

Through this two-phase transaction, the government sold 45 per cent of its stake in the PSU for Rs 769 crore. The present market capitalisation of Hindustan Zinc is a whopping Rs 87,500 crore. That means the 45 per cent stake sold by government is now worth approximately Rs 40,000 crore, 50 times higher than the sale price.

This PSU, sold for an enterprise value of around Rs 1,800 crore, now makes a net profit of Rs 8,000 crore every year, thanks to a huge rally in metal prices during the last decade, though analysts would like us to believe that the company is making such huge profits entirely due to the private entity’s efficiency in achieving better mining operations.

The year of divestment, 2002, was an abysmal year for Indian and the world economy. In the previous year of 2001, there were attacks on the World Trade Center in the US which led to a global recession. Metal prices were quoting at their rock bottom level. But a turnaround in commodity price cycle led to the unlocking of value in Hindustan Zinc.

Clearly, the strategic divestment in the nine profit-making PSUs was done at an unfavourable time leading to realisation of only meagre proceeds by the government.

Killing the competition

IPCL, one of India’s leading petrochemical products company, with three major petrochemical manufacturing complexes at Vadodara, Bharuch and Nagothane, was then making a net profit of around Rs 500 crore per annum.

The 26 per cent controlling stake in IPCL was sold to Reliance Industries Ltd (RIL) for a consideration of Rs 1,491 crore. IPCL has latter been merged with RIL. IPCL was then the only major competitor to RIL in the petrochemical space. After the sale and merger of IPCL, RIL now has a virtual monopoly in the petrochemical sector with more than 80 per cent of the market share.

Telecom PSU VSNL and software PSU CMC were sold to Tata group. VSNL had surplus land of 773 acres in cities like Delhi, Chennai, Kolkata and Pune, worth Rs 15,000 crore. After 16 years, this surplus land has now been hived off into a separate company but its monetistion is yet to start.

Though there were determined efforts by the NDA-1 government to privatise premier oil-marketing PSUs like HPCL and BPCL and aluminium major Nalco, it could not be done due to strong resistance from the labour unions. It was alleged that the “big private players” used the “ideology-driven disinvestment moves” of the NDA-1 government to corner these prized PSU companies for throwaway prices.

Lessons from earlier strategic divestment

A better option is always to retain the family silver and nurture it. If strategic sale is a must, then there are some important lessons to be learnt by the Modi government from the earlier strategic divestment.

Air India, Bharat Petroleum Corporation Limited, Container Corporation of India, BEML, BHEL, etc. are on the block. Taking the example of the disinvestment of Hindustan Zinc, the government should sell only a small stake of 15 to 25 per cent to the private entity, along with transfer of management control.

After value is unlocked by the private player, the government can sell the balance stake at a much higher price. For each PSU earmarked for divestment, the timing should be right in order to fetch the right price.

In the name of strategic divestment, the government should not kill the competition and market forces as was the case in the divestment of IPCL. If competition is killed, downstream industries and consumers will suffer. Strategic divestment of PSUs cannot be an exception to this cardinal principle.

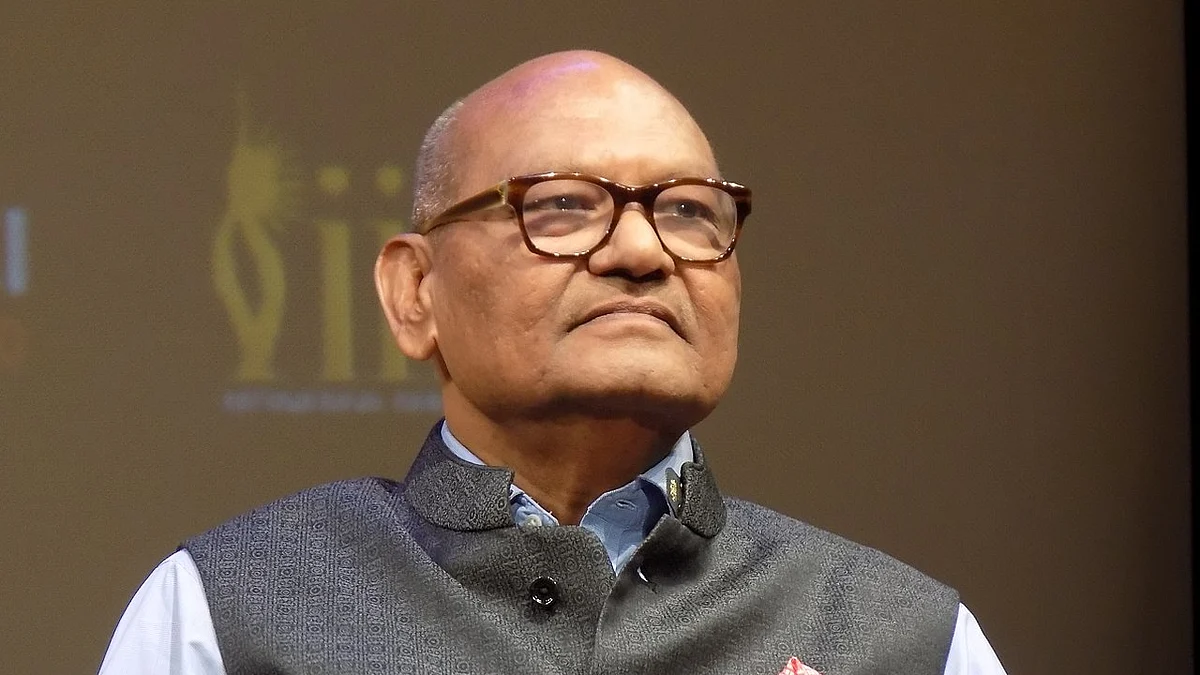

(V Venkateswara Rao was a senior executive in IPCL. Views expressed are personal)

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines