A pre-budget reminder to the Finance Minister on the Indian economy

With 60% without a productive job, 120 million pushed below the poverty line, with Adanis and Ambanis deriving profit from the domestic market, Indian economy needs a course correction

In the decade between 2006 and 2016, the World Bank estimated, India raised some 140 million of its poor above the poverty line.

PEW now estimates that some 120 million Indians have been pushed into the ranks of the poor in the last two years.

A private survey, reported by the Indian Express, indicated that income of the lowest 20% of Indians dropped by 183% over the last two years (2020-2022). In this same period, income of the uppermost 20% of Indians increased by 56%.

I am talking of current income, not wealth.

There is no escaping from the fact that the abrupt lockdown ordered by PM Modi caused enormous harm to the economy, tanking GDP by 7.3%, the highest contraction suffered by any economy in the world. This contraction [28% of GDP over one quarter] destroyed millions of jobs and income that Modi has made little effort to replace.

Modi’s response to MSMEs going out of business and the resulting loss of jobs and income, has largely been confined to propping up firms with additional credit and offering free food grains to the needy. This however compensated only a small fraction of the lost income.

The incremental credit lines, while undoubtedly welcome, do nothing to solve the insolvency problem of firms that lost income. Most have or will drop out of business, their sales shifting to the larger corporate sector competitors. Thus, the most dynamic sector of our economy, that compels the bigger ones to innovate, lies devastated. To understand this, visit a Kirana shop in a small town, and ask for “loose pasta.”

This is the main reason why the Labour Participation rate [LPR] is now below 40%. About 60% of all Indians today are without a productive job.

I wonder how Jerry Rao (link to his article can be found below for those who want to understand the context) expects India to create world beating champion firms, when 60% of Indians are idle, but who still must be fed, clothed and housed by those working in such firms. As Jerry would know, overheads don’t go away but contracts do.

These idle Indians have also to be paid for by those very firms, indirectly, if not directly, which makes such firms uncompetitive in global markets, unless their products have very high labour content, like commodities or software services. It is a vicious circle that neo-liberals refuse to recognise, much less address.

If Jerry is patient, he will find neither Adani nor Ambani firms, as a group, are net exporters. Their profits largely come from the domestic economy, sheltered behind high protectionist tariff walls that Modi has helpfully created for them, in return for sumptuous contributions to Anonymous Electoral Bonds [AEBs], making BJP the richest political party, with declared assets in excess of 5,600 Crores.

INDIA’S TAX-GDP RATIO

Kautilya did favour an alliance between merchants and rulers to lord over the Shudras whose job was to settle forested land and to expand the kingdom’s income. But we have long run out of forested land to snatch from autochthons, and the model no longer creates enough value to feed an idle 60% of the population. The 60% idle overhead is crippling.

Wealth is very poorly measured by the numbers thrown up by mark-to-market of assets. Much of it is not convertible into cash, and even if it is, doing so would lead to terrible disruption in the business of the underlying firms, costing more to the economy, than any tax one could collect from owners.

Besides, accounting for real wealth lags reality because Capitalism destroys wealth even as creates it, and our financial systems are very poor at accounting for wealth so destroyed.

Moreover, there are strategies by which the wealthy can pass on such losses to society at large, as the creative-destructive processes of Capitalism junk old assets in favour the new, and so the cumulative wealth that our financial system reports, exceeds by far the actual value of underlying productive assets in use.

Capitalism has cleverly disguised this “ghost wealth” in the system through debasement of currencies to preserve the claims of the rich & privileged. But that’s a subject for another day.

So, yes, taxing wealth is fraught with danger & I would never advocate a wealth tax, except in an emergency and that too for a limited period. Jerry Rao is right in questioning the efficacy of a wealth tax to address the issue of pauperisation of the poor. But his polemics is in poor taste.

Karl Popper famously said, “In so far as a scientific statement speaks about reality, it must be falsifiable: and in so far as it is not falsifiable, it does not speak about reality.”

Jerry’s propositions 1 to 4 of Positive Economics, that he offers to Oxfam, suffer from this disability. They are not falsifiable and are therefore meaningless & trivial. For them to be true requires independent proof, of which Jerry offers none.

You could say Jerry is incensed by wealth tax because he wants to avoid it. There is no proper way to falsify this statement and hence it fails to pass the Karl Popper test for truth. Jerry’s propositions are as much rubbish as the statement asserted here.

True equality is not one of income, or wealth, but one of opportunity and dignity. The longing for equality of opportunity and dignity is primeval. In fact, the yearning for equality is just liberty from dominance by another. A slave doesn’t seek equality though she may verbalise it so. She seeks freedom from owner.

On the other hand, without recognition of property rights, no social or economic progress would ever be possible because if you cannot enjoy the fruits of your own creativity and labour, your incentive to put in extra effort vanishes.

Sure, there are altruistic people who will work for nothing. But what is the percentage of such altruistic people in any given population? Even if it were to be 50 percent [in reality, it hardly exceeds 5%], the advantage of a sound system of property rights, is that it enables you to harness the ungrudging energies of the selfish and the altruistic, for the common good of the population, using the invisible hand of the market.

The willing co-operation of 100% produces far more than that of the altruistic 5%, plus the grudging co-operation of the balance 95%, without the need for a police state.

When free people bargain for goods between themselves, setting up prices for each good or service, and such bargains are made enforceable by sovereign power through a system of contracts, the system produces the maximum good for all.

As Edmund Burke, and more recently Roger Scruton have argued, this system of bargains freely made by free men between themselves, in fact guides not just economics, but also common law and social practices.

In fact, Roger Scruton argues Capitalism, and the Industrial Revolution, began in England, and not elsewhere, because the laws and social practices of the English, over the millennia, recognised “discovered law” in practice over normative laws imagined by some despot or ecclesiastical authority.

If only Jerry Rao could teach the RSS that free bargains, freely made by free men among themselves, produces a better and more efficient division of labour than the caste system that it is determined to uphold, about half of India’s political, social and economic problems would be resolved.

Yes, every society tried every other devise to make other humans work for the powerful, whether it was by capture, slavery, enslavement through debt, caste or ecclesiastical doctrines thought up by the devious. But most gave them up 1000 years back.

The luminaries of the RSS however persist with caste, and hope to produce global winners. Hallelujah. The notion of equality comes from free men and the capacity to bargain freely and not from income, wealth or social and political status.

However, you need to honour property rights of those who create wealth by their labour, creativity or use of their assets, because you need their contribution to society regardless of their selfish or altruistic motivation.

Distortions & Desperation, not envy

But what of inherited wealth? How does honouring inherited wealth contribute to the welfare of a society? To do so would perpetuate several inequities.

Democracy was an antidote to the inequality inherent in Capitalism and its system of property rights. Not by eliminating inequality, that is impossible; but by moderating it.

One such requirement was that a democracy would also be a meritocracy, and that every child born would have a right to equal opportunity, and dignity, regardless of wealth, power and social status.

Has democracy been allowed to work towards such a goal? If not, what needs to be done?

But Jerry Rao bypasses all the real issues of inequality, to chase a strawman by creating one where none exists: Envy. The easiest devil to slay and dodge real issues within the inequality debate.

The fact is wealth is being used to suborn politics (Anonymous Electoral Bonds, a blatant example) to distort tax policies, (tax cuts to corporates financed by invidious, regressive, indirect, taxes on the middle class and extortionate taxes on fuel) create sheltered markets with govt guaranteed rents for tycoons, (Govt. guaranteed post-tax of 9% return on capital employed in a refinery, in perpetuity, with no time limit, or 12% post tax return guaranteed to thermal power projects, the staple of Ambani & Adani fortunes), explicit subsidies to the corporate sector (production linked incentives) and disguised subsidies to tycoons through corporate loan write-offs that have reached scandalous proportions but are not even recognised as a disguised subsidy, though for asset gathering tycoons, they are road to Riches.

On the other hand, social ostracization is pushing minorities out of job markets, property expropriated in riots is never returned, sometimes not even compensated, their economic space in the marketplace is being systematically shrunk, children of the poor can no longer access higher education as before; I could go on. How does any income or wealth disparity come into play in the inequities above?

When you push people with a daily income of less than $3 into the ranks of the poor, you are pauperising the already poor. They are fighting for survival. Their children are no longer in school; their children have no cell phones for online classes. Jobs and incomes are shrinking. Girls are brought into the marriage market early, while you pretend to raise the minimum age at which girls can legally marry to 21 from 18.

It is not envy that drives them; it is desperation. How would you react if your household income shrank by 180% over 2 years?

***

THAT is the issue, and it needs our urgent attention. Pity if Oxfam must bring it to our notice because Govt. propaganda factories focus on building the hologram of the Great Leader. Savage and curmudgeonly attacks on Oxfam betray guilt. Wilful blindness to distress doesn’t help—not the economy and certainly not the people.

I love Kautilya’s dictum that Jerry Rao has picked up from the distinguished former HLL Chair, Gurcharan Das. Let not the ruler “extract” more than a sixth of his subject’s income for his own use.

What is one-sixth? For the mathematically challenged like me, shall we round it off to 16%? What Kautilya says is taxation as proportion of GDP should not exceed 16%.

But what is India’s tax to GDP ratio?

As the following table shows, in the Modi era, taxes have gone up from 10% of GDP, to 10.8% of GDP, but have never reached 16% of GDP, the upper ceiling recommended by Kautilya.

Modi shifted tax burden to consumers

So, what do we make of Jerry’s little jeremiad about Indians being overtaxed? By the way, the world average tax to GDP ratio is 14.9% of GDP, and India is only 72% of the world’s average. Talk of Indians being overtaxed is plain rubbish.

Why has Modi found it necessary to raise taxes by 2 percentage points of GDP, on an average over that of the UPA years? [Average over 7 years].

There is this hoary notion that tax cuts to the rich and the tycoons, create more wealth, and more jobs, while taxing them, reduces wealth, both for the tycoons, and the overall economy. First as we saw above, the Indian economy is under-taxed, not over-taxed. The Govt. extracts only 11% of GDP compared to the 14.9% world average.

Having hit that ball out of the park, Modi did make valiant efforts to shift the burden of taxation from the corporate and tycoons to consumers, although, even under his watch, overall taxes went up from 10% of GDP in the preceding UPA years, to a little short of 12% of GDP, over last 7 years.

Why then does India feel so over-taxed when in fact it is undertaxed?

The answer lies in Govt. spending, something that the RW ideologues love in practice, but pretend to hate in theory. [Michal Kalecki held that all incremental profits of firms in an economy come from the incremental debt that Govt takes on and spends in the economy. He was no Marxist. But he did do a theory of profits, that Capitalism still cannot provide, the irony notwithstanding].

So, perish the thought that RW hate Govt spending. They love it. What they hate is the fact that some of it goes to the poor, rather than their own pockets - both in the US and India. But back to our story.

Modi slashed corporate taxes by 1.45 trillion in 2019-20. That amounted to something like 1% of GDP. Not because Modi had the money (he was borrowing 6% of GDP from the market even then) but because he was persuaded that such a step would spur economic growth, create new jobs, increase exports and attract FDI from value chain manufacturers abroad.

What really happened?

Income has shrunk, jobs are few

No new jobs were created. In fact, LPR continued to decline, which began even before the pandemic. It is currently around 38%. Back in 2019 it was 49.3%. FDI has stubbornly remained at the $50 billion level, except for a spike caused by Reliance’s dilution of equity in 2020. Unemployment, even when measured by Govt’s flawed data, went up. GDP growth has continued to tank quarter by quarter, since 2018. Currently GDP stands at the same level as in FY 2019-20. GFCF, a measure of total investment in the economy, by private & public sector, remains below 30% of GDP (it was 28.8% of GDP in FY 19-20.).

On the other hand, per capita income has shrunk from INR 1,08,645 to INR 1,07,801 (7.76%), private consumption has declined from INR 62,506 to INR 59,043 (10.11%). While corporate profits during the same period have zoomed up by at least 50% in real terms.

Not a penny of this bonanza for the corporate sector has created new jobs, increased FDI or resulted in any incremental investment in the economy. On the other hand, Govt debt, as percentage of GDP has climbed from 67% GDP to 90% of GDP, severely restricting further borrowings, crippling further investment in highways, so that PM Modi can land C-130 cargo planes on them.

Theatre has replaced reality

Theatre has fully replaced reality in the public imagination as far as growth and development is concerned.

The notion that tax-cuts to corporates and tycoons create jobs and growth is the usual marketing fiction. Consumption and exports drive growth, incomes, and jobs. Consumption and exports under Modi have been stagnant since 2014. [But for a commodity led blip in exports this year.] Jerry’s economics doesn’t compute.

One last point. The state has never been good at picking champions, whether in Japan, South Korea, USA or UK. Not even in China.

So, what do smart Govts do? They ask firms to compete in the marketplace, in free and competitive markets, and when the market picks up a winner, they help the winner scale up operations, NOT AT HOME, but globally, in export markets.

That’s how MITI built up the Toyotas and Sony’s of the world by having them compete abroad and demonstrate competitiveness BEFORE backing then in overt and covert ways to scale up abroad. The Chinese are doing the same. Those asking for an industrial policy in the US also essentially want the same.

This not the model Modi is following. He is sheltering domestic markets for local tycoons from overseas competition by asking Indian consumers to pay higher prices for products made by rent seeking tycoons.

These firms will never be competitive abroad.

India’s cheapest asset is labour. The tycoons Modi backs are in capital-intensive businesses that seek to shun labour as much as possible. Which is why they don’t create jobs.

The only viable business India has today, apart from labour intensive commodities, is software services, which essentially arbitrages labour across geographies. India’s tech firms hide the sins of Modi’s crony capitalists. Was it not for their exports, India would go belly-up again in a jiffy. Irony? Modi taxes these efficient firms to favour sunset manufacturing. Modi’s polices are weird.

Fact is Koch Brothers in the USA, and their counterparts in the Priesthood of Indian Capitalism, have distorted Adam Smith’s version beyond recognition. Where Adam Smith favoured enterprise, KB have corrupted it to mean wealth. Where Adam Smith favoured open competition among many small firms chasing profits, Koch Brothers in practice aim for freedom to use pricing power of big firms to scrounge consumers. Republicans seek to empty the public trough through tax cuts for themselves, financed by Govt borrowings, so that Democrats can’t redistribute anything significant. Meanwhile, plutocrats have captured democracy. This is the situation in a democracy where institutions still function and demagogues like Trump can be evicted from office.

What of a democracy in India, where law and justice are largely dispensed through patronage systems, and Govt accountability is fiction?

The old notions of Capitalism and Socialism don’t hold. It is time we stopped pushing worthless dogmas at people. Better to back the fascists openly if you like their agenda. People as usual will figure a way around even such evil. They always have; they always will. Only the costs can be terrifying.

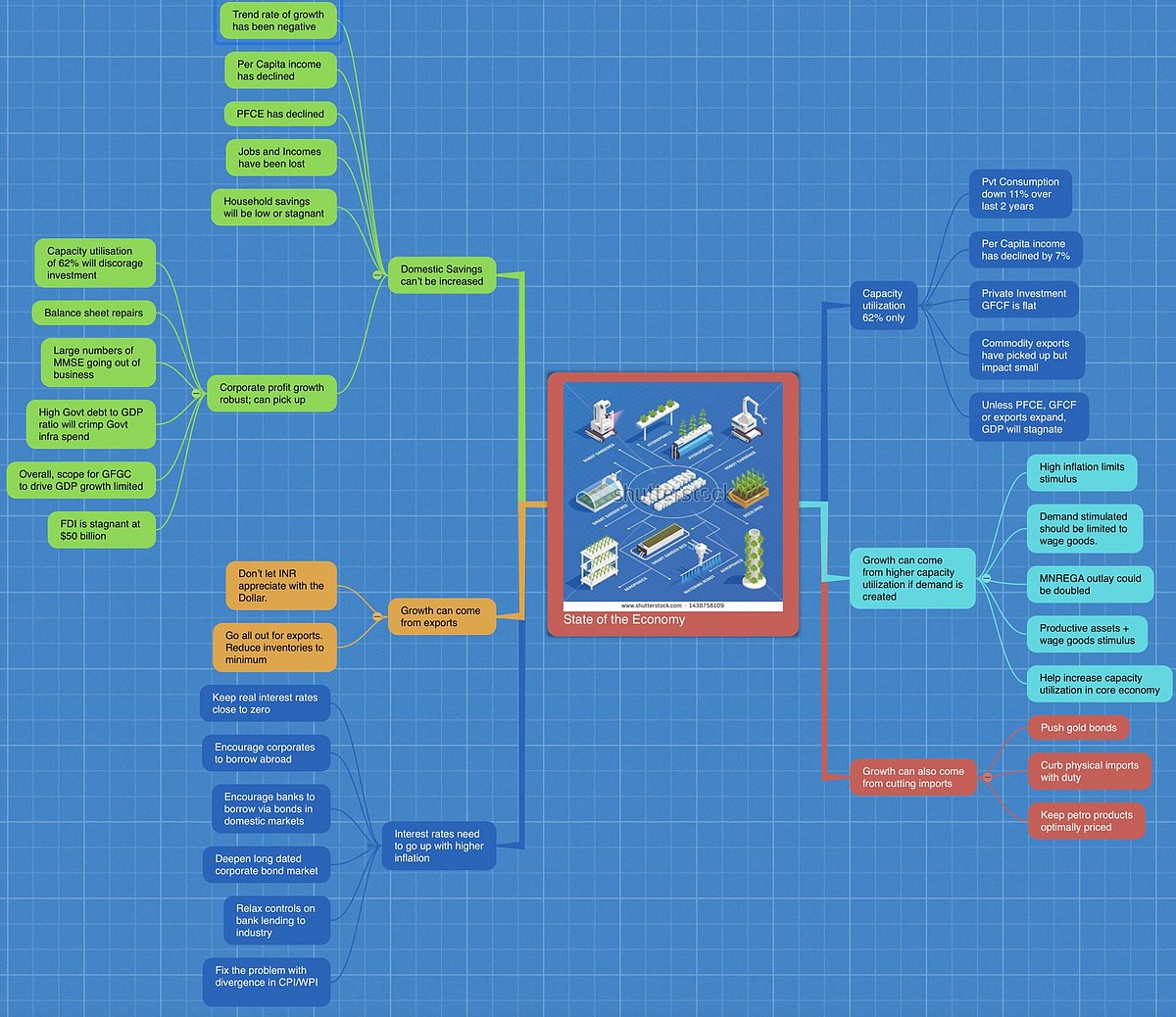

The poor and distressed need urgent attention. Private per capita has consumption has shrunk by 11% over last 2 years. Capacity utilisation in the economy is barely 62%. With such low-capacity utilisation, expecting private investment to take up the slack is silly. Meanwhile, with Govt debt up at 90% of GDP, Modi can no longer borrow more to replace private investment by Govt. expenditure as in the past years. Without growth in consumption, or a substantial increase in exports, the economy will stall. Meanwhile an overvalued INR severely limits India’s participation in global markets, while protectionism freezes us out FTAs. So, fairy tales on exports are only wishful thinking

The economy is in dire straits. Govt. needs to focus on getting the poor back to work with programmes such as MNREGA. At last count, 10 million people had raised a demand for a MNREGA job but none were available. Unless we can restore lost income of the bottom 20%, consumption cannot pick up, and neither can the economy. Pillorying those warning of stagflation [WPI inflation is persistent at 14% pa] helps nobody, least of all tycoons.

(The writer is an independent commentator. Views are personal)

(Jaitirth Rao’s diatribe on Oxfam’s Inequality Report can be read here)

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 31 Jan 2022, 11:00 AM