Tax exemptions for political donations: the individual-corporate gap widens

Donations to political parties by individual and HUF donors in recent years have significantly surpassed those made by corporates

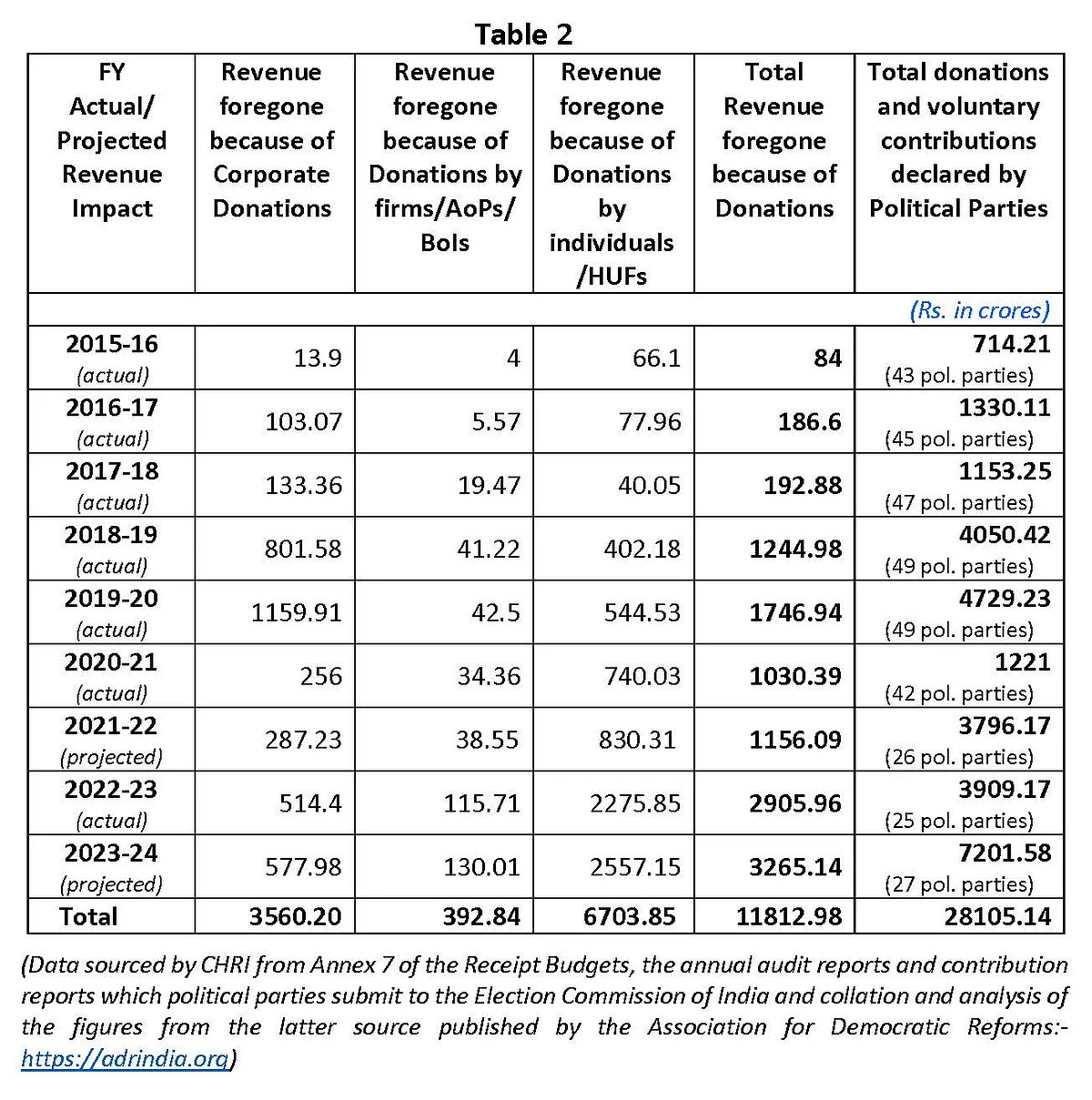

Projections made by the Union finance ministry in the Union Budget 2025-26 for the financial year 2023-24 estimate the revenue forgone owing to donations to political parties is Rs 2,557.15 crore from individual and Hindu Undivided Families (HUF) donations, and a total of Rs 3,265.14 crore overall. For the same financial year, donations to political parties from corporates resulted in a revenue forgone of Rs 577 crore.

In FY 2023-24, 27 political parties declared donations amounting to Rs 7,201.58 crore, a tenfold increase from Rs 714.21 crore reported by 43 political parties in FY 2015-16. Over the past nine years, political parties have received a total of Rs 28,105.14 crore in donations, with revenue forgone during this period (both actual and projected) amounting to Rs 11,813 crore.

According to the Election Commission's website, in FY 2023-24, the BJP received Rs 3,967 crore in donations, Congress received Rs 1,130 crore, Trinamool Congress received Rs 618 crore, Bharat Rashtra Samithi received Rs 580 crore, Telugu Desam Party received Rs 274.65 crore, BJD received another Rs 245.5 crore, and Yuvajana Sramika Rythu Congress Party (YSRCP) received Rs 184 crore. This was the final year in which electoral bonds were in circulation.

During the previous Lok Sabha election, in FY 18-19 and FY 19-20, the total contributions reported by the political parties for those two years were Rs 8,779.65 cr (Rs 4,050.42 + Rs 4,729.23). For FY 23-24, which is the first year of the 2024 Lok Sabha elections, just 27 parties have declared as having received Rs 7,201.58 cr. Data for FY 24-25 will be known during the second half of this year.

Venkatesh Nayak, director of the Commonwealth Human Rights Initiative, wonders which socio-economic categories individual and HUF donors belong to, given that their donations to political parties in recent years have surpassed those made by corporates. “Are these contributions primarily from high-net-worth individuals, or are citizens from the middle classes also increasingly donating to political parties?”

Also Read: Electoral bonds: A colonisation from within

Revenue forgone refers to the amount of money that would have been collected by the government if donors were taxed on their donations to political parties at the applicable income tax rates. Donors receive a 100 per cent tax exemption on donations to political parties, meaning that if they donate Rs 1,000 from an income of Rs 10,000 to Party A, only Rs 9,000 is considered taxable income for income tax purposes.

Section 13A of the Income Tax Act provides a similar exemption for political parties, allowing them to receive donations without tax, subject to certain conditions. These include restrictions on cash donations above Rs 2,000 and a requirement to submit income tax returns to the income tax department to maintain their exempt status. If they fail to do so, the department may tax them at the applicable rates for the financial year during which they failed to submit the required returns.

Annex 7 of the Annual Receipt Budget, which details the government's income from various sources such as income tax, corporate tax, customs duties, and GST, also includes information on internal and external borrowing by the Union government. This annex provides the actual tax forgone data for the financial year three years prior and projected figures for the year before. Therefore, this year’s Annex 7 includes actual tax forgone data for FY 2022-23 and projected figures for FY 2023-24.

The revenue impact for FY 2021-22 is not available, as Annex 7 for the financial year 2024-25 has not yet been released on the Union Budget website.

Exemptions claimed for donations

In FY 2015-16, donors claimed tax exemptions on only Rs 84 crore worth of donations, which accounted for under 12 per cent of the total reported donations of 43 political parties. This means that 88 per cent of the donations made did not claim the available tax exemption, despite being eligible under the Income Tax Act.

At that time, individuals and HUFs claimed 78.7 per cent of the tax exemptions, compared to just 16.54 per cent by corporate donors.

However, over the years, there has been a noticeable increase in the number of donors claiming the tax exemption permitted by the Act. In FY 2022-23, 25 political parties declared donations amounting to Rs 3,909.17 crore, with donors claiming tax exemptions on almost three-quarters (74.27 per cent) of this sum.

Over a nine-year period, individual and HUF donors claimed or were expected to claim Rs 6,703.85 crore in tax exemptions — almost double the Rs 3,560.20 crore claimed by corporate donors. (Actual claims for FY 2021-22 and FY 2023-24 have not yet been made public.)

For FY 2023-24, 27 political parties declared donations totalling more than Rs 7,203 crore. However, the I-T department estimates that donors will claim tax exemptions on only 45.33 per cent of this amount (Rs 3,265.14 crore).

During the nine-year period under review, donors across all categories claimed tax exemptions on about two-fifths (41.76 per cent) of the total donations made, which amounted to Rs 11,812.98 crore. This figure remains incomplete, as the actual tax exemptions claimed for FY 2021-22 are not publicly available, and projected revenue impact data has been included in the calculation.

Interestingly, the amount of tax exemption claimed by individuals and HUFs has grown significantly. In FY 2015-16, they claimed Rs 66.1 crore (78.7 per cent of the total claims), while by FY 2022-23, this had increased by a staggering 3,446 per cent to Rs 2,275 crore. Despite this increase, their share of total claims fell slightly to 78.32 per cent.

Corporate donors typically claim a lower volume of tax exemption than individual and HUF donors, except in the fiscal years following the general elections to the Lok Sabha. In FY 2018-19, corporate claims amounted to Rs 801.58 crore, and in FY 2019-20, they rose to Rs 1,160 crore, while individual and HUF claims stood at Rs 402.18 crore and Rs 544.53 crore, respectively.

Looking at the data, Nayak highlights that despite the existence of the IT Act’s provisions for claiming 100 per cent exemption for all categories of donors, why have so few claimed this benefit (although the proportion of claimants has increased substantially in recent years)? “What kinds of incentives do donors of all three categories perceive or secure, for donating large sums of money to political parties and paying income tax at applicable rates on such amounts?” asks Nayak.

In FY 2023-24, the trend is expected to reverse in light of the 2024 general elections. Corporate donors are projected to claim Rs 577.98 crore, while individuals and HUFs are expected to claim Rs 2,557.15 crore in tax exemptions. Actual figures will only be available when the Receipt Budget is presented in February 2026, and the projected figures for FY 2024-25 will also be released at that time.

Even in FY 2022-23, when only state assembly elections were held, individual and HUF donors outpaced corporate donors in claiming tax exemptions. Individuals and HUFs claimed Rs 2,275.85 crore, while corporate donors claimed only Rs 514.4 crore.

It is also notable that the volume of tax exemptions claimed by non-corporates such as firms and other groups more than doubled in FY 2022-23, rising to Rs 115.71 crore from Rs 41.22 crore in FY 2018-19 and Rs 42.5 crore in FY 2019-20. The I-T department projects these claims to reach Rs 130 crore in FY 2023-24, with final figures to be revealed in the Receipt Budget in February 2026, alongside projected revenue impact data for FY 2024-25.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 19 Feb 2025, 10:32 PM