Parliament passes Bill to allow 100 pc FDI in insurance sector

Government says move will boost penetration, jobs and competition; critics warn of foreign control, data risks and PSU erosion

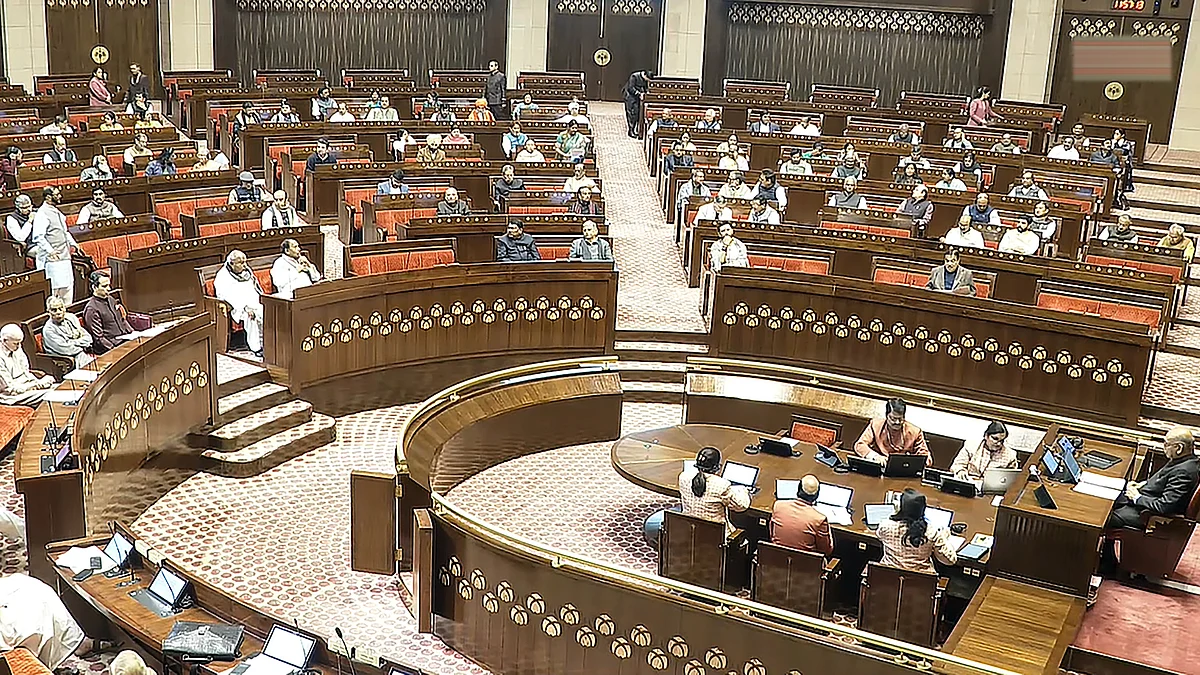

Parliament on Wednesday cleared legislation to raise foreign direct investment (FDI) in the insurance sector to 100 per cent from the current 74 per cent, with the government projecting it as a reform that will deepen insurance penetration and lower premiums, even as Opposition parties accused it of favouring foreign players and undermining public insurers.

The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 was passed by the Rajya Sabha through a voice vote, a day after it was cleared by the Lok Sabha. The Upper House also rejected multiple amendments moved by Opposition members, including demands that the Bill be referred to a parliamentary panel for further scrutiny.

Replying to the debate, finance minister Nirmala Sitharaman said the increase in the FDI cap would allow foreign insurers to bring in more capital and encourage new entrants into the sector. She argued that the gradual opening of the insurance sector over the years had already yielded results and that there was “scope for more”.

Sitharaman said raising the FDI limit to 100 per cent would pave the way for more foreign companies to enter India, noting that many insurers had been unable to expand earlier due to difficulties in finding joint venture partners. With more players, she said, competition would intensify and premiums should fall.

Addressing concerns about employment, the finance minister rejected the Opposition’s claims that the move would hurt jobs. “On the contrary, there will be more employment opportunities,” she said, citing data that showed jobs in the sector had nearly tripled since the FDI cap was raised from 26 per cent to 74 per cent. She also refuted allegations that the government was rushing the Bill through Parliament, saying consultations had been held for nearly two years.

The legislation amends the Insurance Act, 1938, the Life Insurance Corporation Act, 1956, and the Insurance Regulatory and Development Authority Act, 1999. It also allows the merger of a non-insurance company with an insurance firm and provides for the creation of a Policyholders’ Education and Protection Fund aimed at safeguarding policyholders’ interests.

However, the Bill faced sustained resistance from non-ruling members across parties. Several Opposition MPs demanded that it be sent to a select or standing committee, arguing that the changes had far-reaching implications for data security, jobs and the future of public sector insurers.

Congress MP Shaktisinh Gohil objected both to the substance of the Bill and to its title being in a mix of English and Hindi, saying such “mixing of language in legislative business is not permitted at all”. He raised concerns about Indian citizens having to share sensitive personal information such as Aadhaar and PAN details with foreign insurers.

“100 per cent FDI aap laoge… bada khilwaad hoga… Jo videshi log hain unko humare desh ke logon ko apna PAN card, apna Aadhaar card dena hoga. Aur aaj jis tarah se digitalised fraud ho rahe hain kya aap yeh karna chahoge?” Gohil asked, warning of increased vulnerability to financial fraud. He also cited the experience of privatisation in the aviation sector, arguing that monopolies and loss of control could follow in insurance as well.

Trinamool Congress MP Saket Gokhale accused the government of trying to “bulldoze” the Bill through Parliament. He alleged that it would open the door to profit extraction by foreign entities and questioned claims of capital infusion.

Gokhale sought clarity on what commitments foreign insurers would be required to make on rural penetration and profit repatriation, and asked how the government would regulate premium pricing and protect LIC (Life Insurance Corporation of India) and other public insurers. “This Bill should be referred to a standing committee for detailed examination,” he said.

DMK MP Kanimozhi N.V.N. Somu accused the government of weakening public sector insurers while subsidising foreign and private companies. “Over the past nine years, as of March 2024, the insurance sector has attracted nearly Rs 54,000 crore in FDI… Now with 100 per cent FDI, it is expected to touch around Rs 1 lakh crore in the next nine years,” she said. “This means USD 12 billion FDI, the market share of USD 600 billion will go to foreign investors. This is daylight robbery.”

Communist Party of India MP Sandosh Kumar P. described the Bill as “draconian” and warned of “huge protest”, alleging that the government was under pressure from foreign monopolies. He said the BJP was “acting like a British Janata Party” and questioned whose interests it was protecting.

BJD MP Subhasish Khuntia cautioned that insurance was not merely a business but a matter linked to citizens’ lifelong earnings and security, warning that 100 per cent FDI could place complete control of Indian insurance companies in foreign hands. RJD’s Sanjay Yadav demanded a “broad all-party discussion” and referral of the Bill to a parliamentary committee.

Some regional parties extended conditional support. AIADMK’s M. Thambidurai backed the Bill but raised objections to the bilingual title. YSRCP MP Ayodhya Rami Reddy Alla said the Bill spoke of policyholder protection, ease of doing business and regulatory transparency but failed to spell out measurable outcomes.

Defending the legislation, BJP MP Arun Singh accused the Congress of having driven several telecom and banking companies to bankruptcy in the past and said Opposition parties were creating confusion over the FDI provisions. He argued that regulatory control would remain firmly with domestic authorities. BJP MP Bhagwat Karad said the Bill protects policyholders’ rights and mandates insurers to work in rural, unorganised and underserved areas, aiding wider insurance penetration.

With the Rajya Sabha’s approval, the Bill now clears Parliament, marking one of the most significant liberalisations of India’s insurance sector — even as the debate over foreign ownership, data protection and the future of public insurers is set to continue outside the House.

With PTI inputs

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines