Advertorial

Education Loan Qualification 2026: Complete Guide

You can rely on an education loan to bridge the gap between opportunity and ambition

Pursuing your higher education helps you take charge of your future. However, admission to the best universities usually comes with a high cost. Instead of putting your dreams on hold, you can rely on an education loan to bridge the gap between opportunity and ambition. Before you apply, you must understand all the education loan qualification criteria. Being informed empowers you to know the benchmarks in advance, allowing you to prepare accordingly and avoid delays. Let’s explore what you need to know about the qualifications, documents, and more, to apply for an education loan with clarity in 2026.

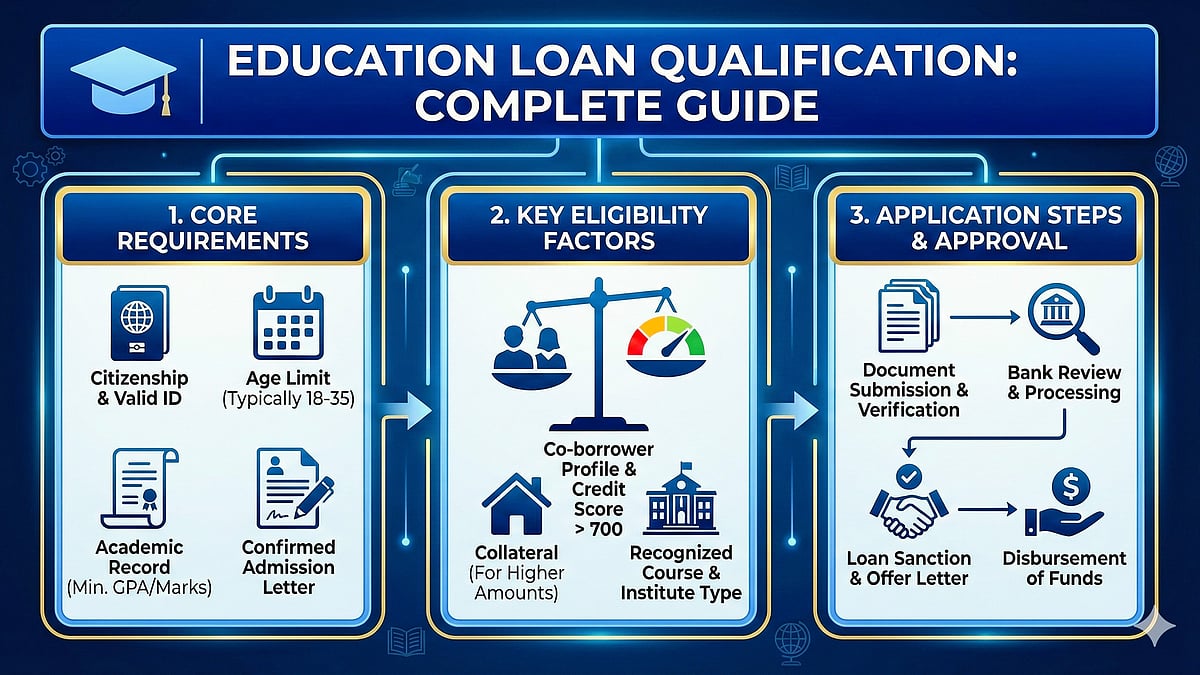

What Are the Education Loan Qualification Requirements in 2026?

To meet the qualification for an education loan in 2026, you must be an Indian citizen, have secured admission to a recognised university or institute in India or overseas, and be over the age of 18. Additionally, most lenders require students to have a parent, guardian, sibling, or other close relative act as a co-applicant or co-borrower. The co-borrower should have a bank account with a stable income in India. Lenders prefer students who have a strong academic background and have a co-borrower with a strong credit history.

Student Loan Qualifications Checklist

Let’s break down the main aspects that most education-focused lenders check before approving an application:

Citizenship and Age

Applicants must be Indian citizens.

The age limit generally falls between 18 and 35 years.

Admission Confirmation

A confirmed admission letter from a recognised college or university is mandatory.

Admission may be through merit, entrance tests, or qualifying exams.

Academic Record

Strong academic performance boosts approval chances.

A few low marks won’t always disqualify you, but consistent grades are preferred.

Co-Applicant Requirement

A parent, guardian, or spouse usually acts as a co-applicant.

The co-applicant’s income stability significantly influences repayment capacity.

Repayment Capability

Lenders look into the financial background of both student and co-applicant.

In some cases, a guarantor may also be requested.

If you’re wondering whether or not you’re ready to apply, here’s a quick checklist of the essential documents you require:

Age and identify proof (Aadhaar, passport, PAN, etc.)

Admission confirmation from a recognised institution

Academic transcripts and mark sheets

Valid co-applicant income proof (salary slips, ITRs, employment letters)

Detailed cost sheet (tuition, accommodation, travel)

Standard KYC documents for applicant and co-applicant

Tick most of these boxes? You’re already halfway there.

Education Loan Eligibility for a Study Abroad Loan

If you require an education loan for studying abroad, you have to fulfil a few additional criteria. You require:

Admission into a globally recognised university or an English-taught program

Valid student visa (or ongoing visa process)

Cost breakdown covering tuition, living, and travel expenses

In some cases, entrance exam scores such as GRE, GMAT, IELTS, or TOEFL may be required

Meeting these requirements ensures smoother approval for overseas education financing.

Answers to the Most Commonly Asked Questions

While applying for an education loan, most students have similar questions. These answers will help you navigate the process easily.

Q: What documents are most important?

A: Your academic records and financial documents can make or break your application. Ensure you keep your admission letter, previous marksheets and transcripts, and your co-applicant’s financial records ready.

Q: Can I apply before final admission?

A: Yes, you can start the application process before you receive your final admission. However, lenders will usually not disburse any of the funds until your admission is confirmed.

Q: Is collateral always mandatory?

A: Absolutely not. Education-focused lenders like Avanse provide high loan amounts that help cover up to 100% of your education expenses even without collateral. However, your chosen lender will evaluate several factors before deciding on the loam amount and terms if you are applying without collateral.

Tips to Strengthen Your Application and Chances for Approval

Meeting all the basic loan eligibility requirements is essential to get loan approval. However, you can take a few extra steps to make your application stand out:

Maintain a strong academic record over several years.

Ensure you prepare complete and updated financial documents for yourself and your co-applicant.

Apply early, giving yourself adequate time to correct errors, submit additional paperwork, and allow your lender to complete the verification and processing.

Maintain a file with all your documents, including your visa papers, admission letters, cost sheets and more.

These small steps will help keep the application process stress-free while improving your chances of approval.

The Case for Preparing Early

If you’re wondering why preparing early is key, let’s break it down. Students usually make the mistake of waiting until the last moment to prepare documents. However, they forget that applying for an education loan takes more than simply filling out a form. The lender will carry out detailed checks on your academics, financials, and your co-applicant’s background.

Applying at the last minute means the lender has less time to complete the necessary verification. You also don’t have time to correct errors or provide additional supporting documents that can help your case. This means you will likely end up facing rejection or missing deadlines. Applying early gives both you and the lender adequate time to work together to address the gaps and submit all the necessary paperwork, easing your path to loan approval and sanction.

For 2026, your loan qualifications are clear: academic performance, admission confirmation, and repayment capability are at the heart of every assessment. Your path to approval depends on thorough preparation. Understanding the requirements, keeping your documents ready, and applying on time will make the process smoother and faster. Preparing in advance leaves you free to focus on your education instead of worrying about funding. Understanding and meeting the eligibility criteria will set you up to turn your dream university acceptance into reality.

Published: undefined

This is an advertorial. The article is published as received.

Published: undefined

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: undefined